Last updated on May 12th, 2024 at 05:37 pm

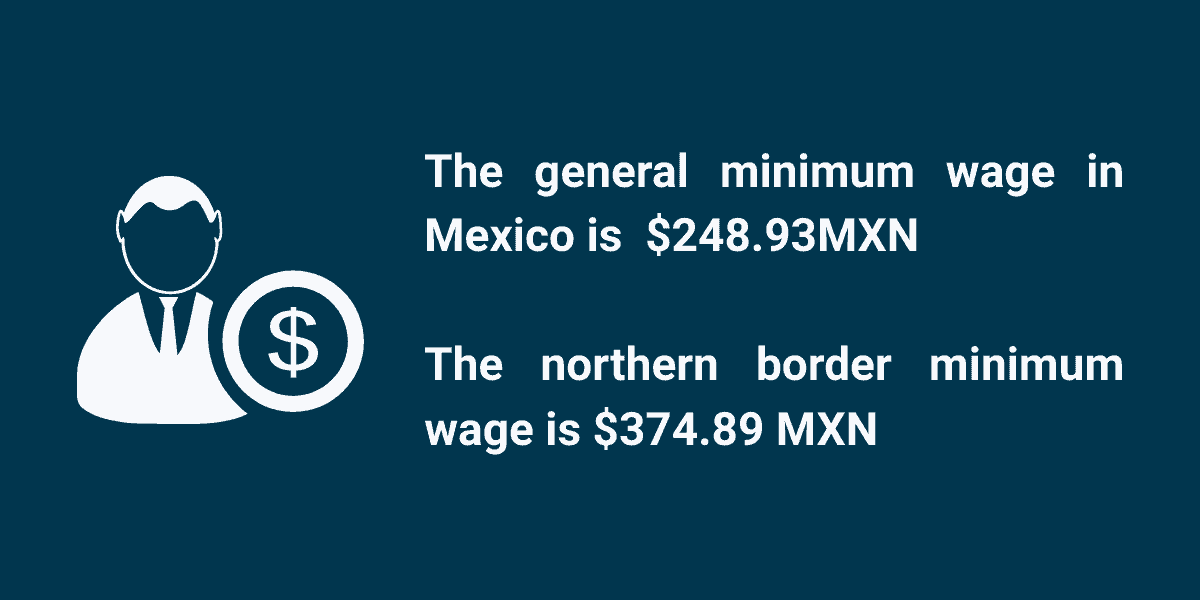

The government updated the minimum wage in Mexico in January 2024, increasing it by 20% compared to the previous year. If you want to start a business in Mexico, it is essential to know this. Mexico has two minimum wages: the General and the northern border area. The northern border area is higher than the general one.

What Is The Minimum Wage in Mexico In 2024

| Type | General Minimum Wage in Mexico | Northern Border Minimum Wage |

|---|---|---|

| Hourly | MXN $31.12 | MXN $46.86 |

| US $1.85 | US $2.79 | |

| Daily | MXN $248.93 | MXN $374.89 |

| US $14.83 | US $22.34 | |

| Weekly | MXN $1,493.58 | MXN $2,249.34 |

| US $89.00 | US $134.04 | |

| Monthly | MXN $7,567.47 | MXN $11,396.66 |

| US $450.96 | US $679.14 | |

| Yearly | MXN $90,859.45 | MXN $136,834.85 |

| US $5,414.46 | US $8,154.21 |

*This is today’s Google Finance exchange rate

Table of Contents

Yearly, Monthly, Weekly and Hourly Minimum Wage in Mexico

Indeed, Mexican law only mentions a daily minimum wage. Therefore, we must use mathematics to understand what this implies at yearly, monthly, weekly, and hourly intervals.

Hourly Rate

Let us begin breaking it down by the hour. The maximum number of hours an employee can work in a given day is eight. So, we can break it down as follows.

| Type | General Hourly Minimum Wage in Mexico | Northern Border Hourly Minimum Wage |

|---|---|---|

| Hourly | MXN $31.12 | MXN $46.86 |

| US $1.85 | US $2.79 |

Weekly Wage

The law in Mexico states the daily minimum wage and that workers must work no more than 48 hours per week. This is all the information we need to calculate the weekly salary.

| Type | General Weekly Minimum Wage in Mexico | Northern Border Weekly Minimum Wage |

|---|---|---|

| Weekly | MXN $1,493.58 | MXN $2,249.34 |

| US $88.99 | US $134.02 |

Monthly Wage

In the same fashion, we can calculate the monthly Mexican minimum wage. To do this, we must multiply the daily wage by 30.41. Why? Well, years have 365 days. If you divide this by 12 months, you get 30.41.

| Type | General Monthly Minimum Wage in Mexico | Northern Border Monthly Minimum Wage |

|---|---|---|

| Weekly | MXN $7,567.47 | MXN $11,396.66 |

| US $450.94 | US $679.12 |

Yearly Wage

Lastly, let us calculate the annual minimum wage in Mexico. All we must do is multiply the daily salary by 365. However, you should not forget about the Christmas bonus called Aguinaldo. This is 15 extra days of salary, and you must pay it to your employees every December.

| Type | General Yearly Minimum Wage in Mexico | Northern Border Yearly Minimum Wage |

|---|---|---|

| Yearly | MXN $90,859.45 | MXN $136,834.85 |

| US $5,413.38 | US $8,152.58 |

Minimum Wage In Mexico For Special Trades

A little-known fact for foreigners starting operations in the country is that, besides the general minimum wage, there is a minimum wage for particular trades. The following table shows these salaries updated for 2024.

| Special Trades & Professions | General | Northern Border |

|---|---|---|

| Masonry, journeyman | MXN $287.17 | MXN $374.89 |

| Counter clerk in pharmacies and drugstores | MXN $253.84 | MXN $374.89 |

| Bulldozer and/or traxcavo Operator | MXN $300.84 | MXN $374.89 |

| Cash register cashier | MXN $258.25 | MXN $374.89 |

| Bartender/drink preparer | MXN $263.53 | MXN $374.89 |

| Black work carpenter | MXN $287.17 | MXN $374.89 |

| Carpenter in the manufacture and repair of furniture | MXN $282.44 | MXN $374.89 |

| Cook, employee in restaurants, inns and other food preparation and sale establishments | MXN $290.81 | MXN $374.89 |

| Official in manufacturing and repair of Mattresses | MXN $266.14 | MXN $374.89 |

| Mosaic and tile installer | MXN $281.44 | MXN $374.89 |

| Plasterer in Construction of buildings and houses, | MXN $268.02 | MXN $374.89 |

| Cutter in shoe manufacturing workshops and factories, official | MXN $260.99 | MXN $374.89 |

| Seamstress making clothes in workshops or factories | MXN $257.88 | MXN $374.89 |

| Seamstress making clothes at home work | MXN $264.65 | MXN $374.89 |

| Driver accommodating cars in parking lots | MXN $269.77 | MXN $374.89 |

| General cargo truck driver | MXN $293.06 | MXN $374.89 |

| General cargo van driver | MXN $284.76 | MXN $374.89 |

| Driver operator of vehicles with crane | MXN $273.92 | MXN $374.89 |

| Dredger, operator | MXN $303.61 | MXN $374.89 |

| Cabinetmaker in furniture manufacturing and repair, journeyman | MXN $286.51 | MXN $374.89 |

| Electrician, installer and repairer of electrical installations, official | MXN $281.44 | MXN $374.89 |

| Electrician in car and truck repair, journeyman | MXN $284.16 | MXN $374.89 |

| Electrician repairer of motors and/or generators in service workshops, official | MXN $273.92 | MXN $374.89 |

| Gondola, shelf or section employee in a self-service store | MXN $253.10 | MXN $374.89 |

| Warehouse and/or warehouse manager | MXN $262.13 | MXN $374.89 |

| Hardware stores and tlapalerías, clerk in | MXN $267.37 | MXN $374.89 |

| Steam boiler stoker | MXN $275.93 | MXN $374.89 |

| Gas stationer, officer | MXN $257.88 | MXN $374.89 |

| Blacksmith, officer | MXN $277.80 | MXN $374.89 |

| Tinsmith in car and truck repair | MXN $282.44 | MXN $374.89 |

| Agricultural laborer | MXN $281.42 | MXN $374.89 |

| Lubricator for cars, trucks and other motor vehicles | MXN $259.82 | MXN $374.89 |

| Handler at poultry farm | MXN $250.36 | MXN $374.89 |

| Agricultural machinery, operator | MXN $288.59 | MXN $374.89 |

| Wood machines in general, operating officer | MXN $275.93 | MXN $374.89 |

| Mechanic in car and truck repair, journeyman | MXN $296.58 | MXN $374.89 |

| Assembler in workshops and shoe factories, official | MXN $260.99 | MXN $374.89 |

| Hairdresser and beauty practitioner | MXN $269.77 | MXN $374.89 |

| Car and truck painter, journeyman | MXN $277.80 | MXN $374.89 |

| Painter of houses, buildings and constructions in general, official | MXN $275.93 | MXN $374.89 |

| Machine ironer in dry cleaners, laundry and similar establishments | MXN $258.25 | MXN $374.89 |

| Plumber in healthcare facilities, journeyman | MXN $276.42 | MXN $374.89 |

| Radio technician, repairer of electrical and electronic devices, official | MXN $286.51 | MXN $374.89 |

| Room attendant in hotels, motels and other lodging establishments | MXN $253.10 | MXN $374.89 |

| Car and truck repairer, counter clerk at | MXN $262.13 | MXN $374.89 |

| Repairer of electrical appliances for the home, official | MXN $272.88 | MXN $374.89 |

| Reporter in daily printed press | MXN $557.41 | MXN $557.41 |

| Graphic reporter in daily printed press | MXN $557.41 | MXN $557.41 |

| Pastry chef or pastry chef | MXN $287.17 | MXN $374.89 |

| Tailoring at home work, official | MXN $288.59 | MXN $374.89 |

| Assistant Secretary | MXN $295.98 | MXN $374.89 |

| Torch or electric arc welder | MXN $284.16 | MXN $374.89 |

| Planner and/or butcher at the counter | MXN $269.77 | MXN $374.89 |

| Automotive upholsterer, official | MXN $273.92 | MXN $374.89 |

| Upholsterer in furniture repair, journeyman | MXN $273.92 | MXN $374.89 |

| Domestic worker | MXN $270.60 | MXN $374.89 |

| Social worker, technician in | MXN $320.65 | MXN $374.89 |

| Machine milking cowboy | MXN $253.10 | MXN $374.89 |

| Nightstand | MXN $257.88 | MXN $374.89 |

| Floor salesperson of household appliances | MXN $264.65 | MXN $374.89 |

| Shoemaker in shoe repair workshops | MXN $260.99 | MXN $374.89 |

A Legal Overview Of Minimum Wage In Mexico

The government established the minimum wage in Mexico in 1917 with the publication of the Mexican Political Constitution. This happend after the Mexican Revolution.

Firstly, The revolution began after a period of social injustice and horrible labor conditions. Therefore, employee protection played a significant role in it.

Consequently, this new regulation included mandatory profit sharing, the establishment of a minimum wage in Mexico, social security for Mexican workers, and better Mexican labor laws in general. Thus, Article 123 of the Mexican Constitution summarizes the entire labor and social welfare framework; it is significant.

However, this article merely mentions that there shall be a minimum wage in Mexico; the Federal Labor Law, which stems from the constitution, elaborates on this. Hence, this law has an entire chapter related to the Mexican minimum wage: Chapter VI.

Lastly, Article 90 of the Federal Labor Law explains the terms and nuances of the minimum wage in Mexico. For example, the government must revise and update the minimum wage in Mexico annually. Of course, this update cannot be below inflation rates.

Who Decides the Minimum Wage In Mexico?

Article 94 of the Mexican Federal Labor Law states that a National Minimum Wage Commission shall oversee this. This commission is called CONASAMI because of its Spanish name. Representatives of form this commission:

- The companies (employers)

- The workers

- The government

An entire chapter in the Federal Labor Law, Chapter VIII, is dedicated to this commission and the procedures to establish the minimum wage in Mexico.

Let us take a look at how it works.

Article 570 of the LFT states that it must be fixed each year and become effective on January 1st. Therefore, feel free to bookmark this article if you want to keep up with it since we update it yearly. Also, if economic circumstances make sense (think of hiper inflation or something similar), it can be revised any time during the year. The process is broadly like this.

- The CONASAMI studies technical reports about the national economic situation. This may include inflation, economic growth, employment rates, etc. They analyze the repercussions of an increase in generalized purchasing power.

- The technical directorate of the Conasami studies this report and decides, in conjunction with the Council of Representatives, on the new Mexican minimum wage.

- The President of the National Minimum Wage Commission orders the publication of the Resolution in the Official Gazette of the Federation

Characteristics Of The Minimum Wage In Mexico

The Federal Labor Law tells us how much the minimum wage in Mexico is and states other limitations for protecting workers. Let us take a look at the most important ones.

Free Disposition Of Wages

Article 98 of the Labor Law states that workers shall dispose freely of their wages. Any measure or agreement that goes against this statement will be considered void. Let us think of an example.

Imagine an employer paying his employees the Mexican minimum wage. Moreover, this employer tells workers they must invest 10% of their salary in the company’s stock. This would be illegal because it does not allow the employee to dispose of his salary freely.

Salary Is Inalienable

Article 99 of the Labor Law states that employees cannot waive their salaries. If the employee and the employer agree that the employee waives his or her salary, this agreement will be void. Therefore, the employer will still have the obligation to pay.

Salary Is Personal

According to Article 100 of the Labor Law, companies must pay the minimum wage in Mexico (and higher wages, too) directly to the employee. Although, there are cases where the employee cannot personally collect. Therefore, only In these specific cases, the employee may designate a person to receive the payment. To comply, the proxy must have a power of attorney signed before two witnesses. If this does not happen, the employer will still owe the money. As a result, the employee may demand the corresponding payment of his or her salary.

Location Of Salary Payment

Employers must pay the minimum wage in Mexico (and higher wages, too) in the work center where the employee renders the services. However, since we live in a modern world, there have been reforms to the law. Today, companies may pay salaries by depositing money in a bank account, using a debit card, transferring money, or other electronic means. However, please note that the employee must accept this. Article 101 of the Labor Law explains this.

This cannot be detrimental to the employee’s salary. Therefore, the employer will cover the expenses or costs arising from these alternative means of payment.

In all cases, the employee must have access to detailed information on the concepts and deductions of payment. The employer must deliver the payment receipts to the employee. If the employee agrees, the employer can provide them electronically (think of a PDF file).

However, if the employee requires it, the employer must deliver them in printed form. This may sound tedious, but many workers cannot access computers or the Internet. This is part of the workforce earning the minimum wage in Mexico.

Authorities Cannot Seize Salary

Employers or any authority cannot confiscate the minimum wage in Mexico (and higher wages, too). Article 110 of the Labor Law discusses this. However, some exceptions apply, which we will see in a moment.

Discounts To The Minimum Wage In Mexico

As a general rule, employers cannot discount the minimum wage in Mexico. However, there are a few exceptions.

- Rent payment: When the employer leases a room to the employee. This amount cannot exceed 10% of the employee’s salary. If you pay more than the minimum wage, the amount applied to the difference can be up to 15%.

- Alimony Payment: This is the only circumstance where a court order may force an employer to withhold a part of the salary and give it to someone else.

- Social Housing Mortgages: Social housing is an employee benefit in Mexico. Employers may discount Installment payments to INFONAVIT, the Mexican Social Housing Institute, from the minimum wage. The worker must accept these discounts when obtaining a loan.

- FONACOT Payments: Installment payments to cover loans granted by the National Fund For Worker’s Consumption Institute (Fonacot). Discounts may not exceed 20% of the employee’s salary.

Discounts On Salaries Above The Minimum Wage In Mexico

For the difference between the contractual salary and the minimum wage, employers can make some other legally authorized discounts in specific scenarios. Let’s take a look at those.

- Debts With The Company: If an employee has debts with the company for reasons like salary advances or purchase of merchandise produced by the company, the company may discount up to 15% on the difference between the current Mexican minimum wage and the rest of the employee’s salary.

- Union Fees: Your workers can affiliate with a union in Mexico. The company usually withholds union fees from the employee’s payment and transfers them to the union. However, workers may request employers (in writing) not to discount these fees.

Salary In Mexico

Even though it may sound obvious, it is essential to understand what Mexican law considers a salary. Here is what Article 82 of the Labor Law states about salary:

Article 82 – Salary is the remuneration to be paid by the employer to the worker for his work.

It sounds simple, but legally, the salary in Mexico has specific legal characteristics that must be met.

Financially Rewarding

Salary must be rewarding, meaning profitable to the employee in exchange for his work hours. This is clearly stated in Article 85 of the LFT. Also, it must never be less than the established minimum wage in Mexico.

Periodicity

The minimum wage in Mexico (and higher wages, too) must be periodic, meaning they occur at intervals. According to Article 88 of the LFT, the deadlines for paying wages may never be longer than one week for persons performing material work and fifteen days for other workers. So, technically, you may pay every week or fortnight.

That said, in practice, some companies pay monthly; this lowers the administrative burden. The legal way to do this is to agree with your employees that you will pay them a fortnight in advance. You pay 15 days of work and 15 days in advance every month.

Legal Tender

Employers must pay the minimum wage in Mexico (and higher salaries, too) in legal tender. They cannot pay their employees in merchandise, vouchers, in-kind, cryptocurrencies, or any other form. It must be money.

Does it have to be Mexican pesos? Nothing in the law forbids it, but it might get messy. Let me elaborate. You may agree with your employee a determined amount of foreign currency, but this must be Mexican pesos at the moment of payment. Therefore, you must also decide on a specific exchange rate.

Other labor laws in Mexico do not allow salary reductions. Therefore, a change in currency exchange to the employee’s disadvantage may be prosecuted as a salary reduction. If you wish to do this, ensure substantial contracts and documentation.

Wage Equality

As the name explains, the minimum wage in Mexico is the minimum you can pay. But companies pay a higher salary to good workers. Therefore, Mexican legislation seeks equality in wage payment. This is stated in Article 86 of the Labor Law. It means equal work gets equal pay. The tricky part is to know what equal work means. So, let us first take a look at what the article states.

Article 86 – Equal work, performed in equal position, workday and efficiency conditions, shall correspond to equal salary.

Essentially, if two workers perform the same work, they should earn the same. Here are the important characteristics.

- Same position: Employees must work in the same position.

- Workday: The law differentiates between day, night, and mixed shifts. Night shift, for example, could pay a higher wage. If someone works longer, he should receive more money. But if the circumstances are the same, they should get equal payment.

- Efficiency: If the productivity of the workers is the same, payment should be equal.

Reciprocity

Salary must be reciprocal to the job performed. Therefore, establishing a minimum wage in Mexico protects workers from paying meager wages. Technically, it should be enough to meet the needs of a head of household. In theory, a person should be able to provide for his family on a minimum wage. However, in reality, this is not the case.

Other Types Of Salaries In Mexico

The minimum wage in Mexico is not the only distinction our legislation makes; we have three different types of salaries.

Minimum Wage In Mexico

The idea behind minimum wage in Mexico is to protect workers from being paid too little. No matter the circumstances, it is illegal for a company to pay less than this amount to an employee. If a company pays less than this amount, the employee may terminate his employment contract (meaning he is entitled to severance payment according to Mexican labor laws). Moreover, the employer may face hefty fines or even going to jail.

Contractual Salary

It is the salary agreed upon between the employee and the company. This salary is the basis for calculating Mexican employee benefits, such as vacation bonuses, Christmas bonuses, overtime, and extra-legal benefits, such as the savings fund and food vouchers.

Usually, this is a fixed amount, but it may also include a variable component like performance bonuses, commissions, etc. The fixed amount may not be less than the current minimum wage in Mexico and the law-determined guidelines (which we will explain in a moment).

Integrated Salary

We have also referred to this as the Base Listed Salary. If you wish to understand it and learn how to calculate it fully, we recommend reading our article about Social Security In Mexico. This type of salary includes not only the amount paid by the employer but also all allowances and performance bonuses. It is used to calculate payroll taxes in Mexico and is the salary you registered at the Social Security Institute.

Any benefit granted to the worker for rendering his services, whether cash or kind, is part of his integrated salary. Therefore, all legal and extra-legal benefits to which the employee is entitled, such as Christmas bonuses, vacation bonuses, savings funds, bonuses, commissions, and incentives, must be considered part of the salary.

For example, giving your employee a car would not be integrated into their salary because this is a work tool. This is an important distinction.

The Northern Border Minimum Wage In Mexico

The border between Mexico and the US is 3,145 kilometers (1,954 miles), which happens with many plants. Therefore, Mexico has had a long-term commercial synergy with the United States. Imagine having a manufacturing company based on the US side of the border and suddenly finding out that 10 miles away, laborers charge a fraction of what you are currently paying. Naturally, you would move your manufacturing plant 20 km to save money.

On the Mexican side, workers were crossing the border to work in these manufacturing plants. So, trying to prevent Mexican workers from crossing the border for higher wages, the government created the Northern Border minimum wage in Mexico.

This situation led the Mexican government to create the IMMEX program, creating the “Mexican Maquiladoras.” Essentially this program lets Mexican companies import raw materials without paying duties or VAT so as long they export the final product. This incentivizes American companies to move to Mexico.

The minimum wage in Mexico has always been a reference for calculating official prices like fines, penalties, and other obligations. Even INFONAVIT mortgages were quoted in “Times Minimum Wage.” This led to difficulties in increasing it; a drastic increase would mean a drastic increase in the mortgage of millions of Mexican workers, making them impossible to pay and causing a collapse of the economy.

Therefore, to detach the minimum wage from the official prices, the Mexican government created the Measurement and Updating Unit or UMA because of its name in Spanish (Unidad de Medida y Actualización) in 2016.

Conclusion

Mexico has two minimum wages, one for the general and one for the northern border area. Although manufacturing companies may pay this salary, it is usually used as a reference more than a salary. Nearshore software development companies in Mexico should not even consider this figure, since the salaries in that industry fall far from it.