Last updated on November 30th, 2023 at 11:24 am

The IMMEX program is the legal framework that regulates maquiladoras in Mexico. It is one of the Foreign Trade Incentives Programs the Mexican government has implemented to make the country more competitive.

This comprehensive article discusses everything foreign manufacturers need to know about the IMMEX program and what maquiladoras in Mexico are about.

First, let us tackle the name. IMMEX stands for Industria Manufacturera, Maquiladora y de Servicios de Exportación; the literal translation gets tricky because of the word “Maquila.” For the last few days, I have been questioning my knowledge of Spanish while looking for a translation of this word into English. Technically, Maquila means “to perform a partial part of a production process,” although sometimes it is used interchangeably with “outsourcing.”

Now that we know that, we will use the term in Spanish throughout the article since there is no direct translation. So the IMMEX program is a manufacturing, maquila, and export services government program aimed at making Mexico more competitive internationally at attracting foreign investment. Maquiladoras in Mexico are companies that have enrolled in this program.

History Of Maquiladoras In Mexico

The Mexico-US border Maquiladoras in Mexico have a long history dating back to 1965 when the IMMEX program’s first predecessor was created. It was called the Northern Border Industrialization Program. The idea was to create jobs and strengthen the country’s trade balance by increasing net exports. This led to a boost in the northern border industrialization due to the transfer of technology from the US to Mexico. In the following decade, plenty of industrial parks were built in the border states of Sonora, Chihuahua, Coahuila, and Baja California.

In 1972, this program was extended to be valid in the entire country instead of just on the northern border. Also, further regulation was created to regulate maquiladoras in Mexico in the Customs Code, and INEGI, Mexico’s Statistics Institute, started to collect statistical information on it.

Maquiladoras in Mexico saw their most significant growth when Mexico joined the North American Free Trade Agreement in 1994. This growth set the foundation for the IMMEX program we know today, issued by decree in 2006.

IMMEX Program Overview

The IMMEX program allows Mexican companies to import products under a special customs regime called the “special regime for producing, transforming, or repairing merchandise.” This means your imports can enter the Mexican territory for a given time and cannot exceed this period before they are exported back. The IMMEX program only applies to manufacturing since the products imported must undergo one of the following processes.

- Production. When you import raw materials and submit them to a process that does not change their chemical properties. Tables, t-shirts, or whatever you can think of that does not chemically changes qualifies as production.

- Transformation. If there is a chemical process involved, a transformation takes place. The final product would be an entirely different substance than the imported one. Consider importing ingredients and turning them into a food product, like a cake.

- Repairing. IMMEX program also allows for repairing or refurbishing. If you import a TV to get repaired and export it after, you can get the program’s benefits.

What type of goods can be imported under the IMMEX program?

The IMMEX program allows companies to import everything they need to carry out an industrial manufacturing process.

- Raw materials, parts, or components.

- Fuels, lubricants, and other materials that are consumed in the process.

- Packaging, containers, labels, etc.

- Shipping containers and boxes.

- Machinery, equipment, tools, and any instrument involved in the process.

How long can the imported goods remain in Mexico?

Article 108 of the Mexican Customs Law states how long maquiladoras in Mexico can import goods through an IMMEX program.

- Up to 18 months for fuels, packaging, labels, containers, raw materials, parts, and components (the below exceptions apply).

- Up to 12 months for raw materials specified in Annex II of the IMMEX program decree.

- Up to two years, in the case of shipping containers and trailer containers.

- For as long as the company is enrolled in the IMMEX program for lubricants and goods consumed during the process (except fuels), pollution control equipment, laboratory equipment, management equipment, measurement equipment, and quality control equipment.

Annex II Of The IMMEX Program Decree

"Too Many Requests"

Is there something I cannot Import to Mexico under the IMMEX Program?

Some goods cannot be imported under the IMMEX program; these are stated in Annex I of the IMMEX Decree.

Annex I Of The IMMEX Program Decree

| Tariff Code | Goods |

|---|---|

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.4 but less than 99.5 degrees. |

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 96 but less than 99.4 degrees. |

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization of less than 96 degrees. |

| 1,701.13 | Cane sugar referred to in Subheading Note 2 to this Chapter. |

| 1,701.14 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.4 but less than 99.5 degrees. |

| 1,701.14 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 96 but less than 99.4 degrees. |

| 1,701.91 | With added flavoring or coloring. |

| 1,701.99 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.5 but less than 99.7 degrees. |

| 1,701.99 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.7 but less than 99.9 degrees. |

| 1,701.99 | Others. |

| 1,702.90 | Refined liquid sugar and invert sugar. |

| 1,702.90 | Others. |

| 1,806.10 | With a sugar content equal to or greater than 90% by weight. |

| 2,106.90 | Flavored or colored syrups. |

| 2,207.10 | Undenatured ethyl alcohol with an alcoholic strength by volume of 80% vol. or higher. |

| 2,207.20 | Ethyl alcohol and denatured spirits, of any alcoholic strength. |

| 2,208.90 | Ethyl alcohol. |

| 2,208.90 | Alcoholic beverages of more than 14 degrees but not exceeding 23 Gay-Lussac centesimal degrees at a temperature of 15°C, in earthenware, earthenware or glass vessels, except those included in 2208.90.04. |

| 4,012.20 | Of a kind used on vehicles for the road transport of passengers or goods, including tractors, or on vehicles of heading 87.05. |

| 6,309.00 | Clothing items. |

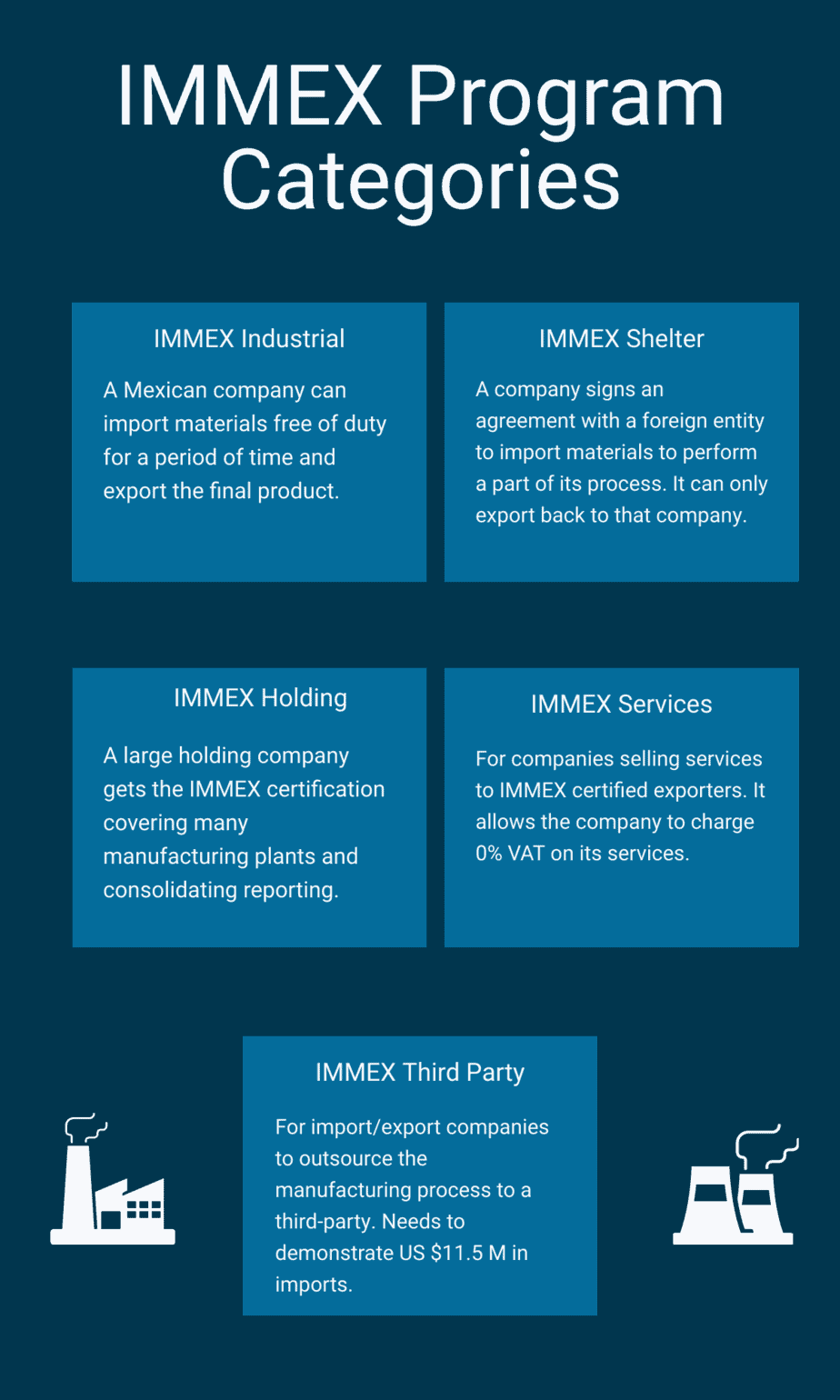

Categories Of The Program

There are five different categories of the program targeting different types of companies.

IMMEX Holding

The IMMEX Holding program certifies holding companies with different manufacturing plants nationwide. Suppose each plant has a different manufacturing process; it would be too difficult for each plant to subscribe to the IMMEX program. So the program allows the holding company to register as an IMMEX holding; this way, the whole corporate structure works under the same registry.

In practice, each of the manufacturing plants sends its information to the holding company, and the holding company is the one that presents all the reports to the authorities. The idea behind it is to simplify the red tape for large companies.

IMMEX Industrial

The most common type of IMMEX is the industrial version. Under the industrial version, a Mexican company can import the supplies (parts, components, containers, raw materials, packaging materials, machinery, etc.) for a limited time. The company will proceed to process what produce, transform, or repair the imported goods, and once the manufacturing process is done, it will export the final product.

An essential part of this version is that your suppliers and clients are entirely separated, unlike the shelter program, which we will discuss in a moment.

IMMEX Shelter

When people talk about maquiladoras in Mexico, this is what they mean. In the shelter version of the IMMEX program, a Mexican company enters a contractual agreement with a foreign manufacturing company. The foreign company subcontracts the Mexican company to perform one part of the production process. Let us think about Calvin Klein using shelter services in Mexico to make t-shirts.

Unlike the industrial modality, in the shelter IMMEX program, the client and supplier are the same. In this example, Calvin Klein would send all of the technology and supplies (fabrics, chemicals, machinery & equipment, etc.), and once the Mexican shelter provider has finished, he can only export it back to Calvin Klein. For an IMMEX shelter to exist, there must be a subcontracting agreement between a foreign company and the shelter provider. These are known as maquila contracts.

IMMEX Services

The IMMEX program for services is for Mexican companies that offer services to industries related to exporting. There are two situations where this could happen.

- A company is performing a service to another company that exports. A good example would be a sanitizing company offering its services to industrial facilities. Usually, they would charge a 16% VAT on their services. However, if it is certified under the IMMEX services program when working for other IMMEX clients, they would charge a 0% VAT because it would be considered an exported service.

- Another situation could be printing. Suppose a Tijuana printing company will print all the packaging materials for a food company in San Diego. The company would import the plastic packaging rolls free of taxes, print the food company’s logo, nutritional facts, etc., and then export those rolls back to the US.

IMMEX Third-Party

The idea for the third-party IMMEX program is for import-export companies to procure export projects, import the merchandise and outsource the manufacturing process to a third party. After the procedure, the import-export company will export the final product. To enroll in this program, the Mexican company must demonstrate to have imported around $11.5 million USD pesos, making it a program for larger companies rather than SMEs.

Benefits Of The IMMEX Program

Each variation of the program categories has benefits suited for that particular type of company or business model. In this article, we will focus on IMMEX Industrial and IMMEX Shelter, which are the most common categories of the program.

Benefit 1. Not Paying Import Tariffs

The first benefit of the IMMEX program for maquiladoras in Mexico is to avoid paying import duties. Since the merchandise will be exported back out of the country after the temporary import timeframe expires, you can enter the merchandise into the country, manufacture your products and export them without paying import tariffs.

However, since foreign trade is a complex area, there are some scenarios where even companies enrolled in the IMMEX program have to pay import tariffs, but they get the benefit of deferring these taxes until the moment they export the final product, which is excellent for a company’s cash flow.

Import Tariff Deferral

When triangulation is involved within the USMCA or EU Trade Agreements, import tariffs are not avoided but deferred. Triangulation means that you are importing merchandise from China, for example, or whatever country that does not belong to the USMCA and, therefore, should not benefit from this agreement. If this is the case, all the import tariffs will be calculated when importing the merchandise, but you do not immediately pay it. You can do your manufacturing process and pay for it when you export the final products. Hence the name import tariff deferral.

It is essential to know there may be an update of the tariffs due to inflation during the time the merchandise is in the country. That is one of the reasons why IMMEX companies must have accurate (and ideally short) production cycles. The inventory software that IMMEX companies must use can significantly help, but we will get there in a moment.

Benefit 2. Not Paying Value-Added Tax or Excise Tax

As a side note, before 2013, IMMEX companies were automatically exempt from paying Value-Added Tax (VAT) and Excise Tax (IEPS, because of its name in Spanish). However, after that reform, it got a little more complicated. Now, According to Article 28-A of the Mexican VAT Law and 15-A of the IEPS Law, for companies to be able not to pay these taxes, they must either have additional certification or “guarantee the tax interest” using a bond or letter of credit.

This leaves us with three options.

- To pay the VAT and IEPS and asking for a refund once the final product is exported (not recommended).

- A bond guarantee or letter of credit from an authorized financial institution.

- Getting VAT-IEPS certified

1. Paying VAT & IEPS And Request A Refund

This option is the least recommended of the three since it is not optimal for the company’s cash flow. How it works is that you would pay full VAT and IEPS taxes when the merchandise is imported. After you have exported the final product, you would ask for a refund, as any company with creditable VAT in Mexico would, according to Article 22 of Mexico’s Federal Fiscal Code.

Needless to say, the authorities are never too keen on giving money back, so this can be a lengthy process. In theory, getting VAT & IEPS back this way takes 40 days, but in a worst-case scenario, it could take up to 100 days.

2. VAT-IEPS Bond Guarantee or Letter of Credit

To understand this, you must consider the tax authority as a commercial partner. If they can be sure that you will indeed export your final products in a compliant way or pay the taxes if you do not, they will be at ease. So, as with any other commercial partner, you can bring a third party (a financial institution) to guarantee this. Article 141 of the Federal Fiscal Code discusses how tax interest can be guaranteed. The most common is a guarantee bond or a letter of credit from an authorized institution.

Usually, this bond guarantee/letter of credit is requested every time a company imports goods. Once that batch of imported goods is exported, you cancel the bond with the financial institution. Another option is to get a revolving bond/letter of credit for the global amount of imports the company has forecasted for the year.

As you may notice, this is not ideal because of two things.

- The bond guarantee/letter of credit has a cost.

- The administrative burden of procuring these bonds/letters of credit is high.

Here is a list of the financial institutions authorized by the Mexican tax authorities to issue bonds/letters of credit to guarantee the tax interest of companies in the IMMEX program.

Name |

Logo |

Rating |

|---|---|---|

Aseguradora Aserta |

|

|

Afianzadora CBL Fiducia |

|

|

Aseguradora Insurgentes |

|

|

Sofimex, Institución de Garantías |

|

|

CESCE Fianzas México |

|

|

Berkley International Fianzas México |

|

|

Crédito Afianzador |

|

|

Fianzas Asecam |

|

|

Fianzas Atlas |

|

|

Fianzas Guardiana Inbursa |

|

|

Dorama, Institución de Garantías |

|

|

Liberty Fianzas |

|

|

Mapfre Fianzas |

|

|

Zurich Fianzas México |

|

|

Fianzas Avanza |

|

3. Getting VAT-IEPS Certified

The third option is to get a VAT-IEPS certification. With it, IMMEX companies can get a tax credit for 100% of the VAT and IEPS taxes on imported goods. Besides not paying VAT and IEPS on imported goods, companies can access an accelerated VAT refund scheme according to their certification category.

It is essential to understand that this certification is not easy to obtain, and it is not easy to maintain either. Companies must renew it yearly, and requirements must be met. If you wish to get IVA-IEPS certified, please get in touch with us so we can look closely at your case.

The tax authorities have three categories for this certification.

- Type A. certified companies will obtain a 100% tax credit on their IMMEX program temporary customs regime imports. They will obtain the VAT refund within a period not to exceed 20 days from the day following the filing of the respective application. Companies with a type A certification have access to a VAT refund of 20 business days (as opposed to the 40 business days it usually takes).

- Type AA. This category also obtains a 100% tax credit on imports plus a 15 business days VAT refund.

- Type AAA. Besides the 100% tax credit on imports, this category gets VAT refunds in 10 business days.

General Requirements to Get VAT-IEPS Certified (Type A)

The following are the standard or general requirements to be VAT-IEPS certified. These are the minimum requirements to obtain the type A certification.

- Have a valid IMMEX program certification.

- Being up to date in all tax & customs payments and having a favorable tax compliance opinion by SAT.

- Suppliers must NOT be on the list of companies published by the SAT as Shell or Fraudulent Presumed Companies.

- At least ten employees are registered at the Mexican Social Security Institute (IMSS).

- Having all the registered addresses of the company updated.

- Have the necessary infrastructure to carry out the operation of the IMMEX Program.

- Have temporarily imported goods under its IMMEX Program and have returned 60% of the value of temporary imports of inputs during the last 12 months.

- Have a maquila contract, purchase and sale contract, purchase or service order, or firm order to prove the export project’s continuity.

- Allow the General Foreign Trade Auditor Unit at all times to perform inspections.

- To have an IMMEX-approved inventory system.

Type AA Certification Requirements

To become certified as a Type AA IVA-IEPS company, you must comply with the following requirements on top of the general requirements.

- To have been enrolled in the IMMEX program during the last four years or more. Or that, on average, during the last 12 months, they had more than 1,000 workers registered with the IMSS or that their machinery and equipment is greater than $50,000,000 MXN.

- They were not notified of any tax penalty in the prior 12 months.

- To not have VAT refunds rejected for more than 20% of the authorized refunds and/or that said amount exceeds $5,000,000 MXN in the prior six months.

Type AAA Certification Requirements

- To have been enrolled in the IMMEX program during the last seven years or more. Or that, on average, during the last 12 months, they had more than 5,500 workers registered with the IMSS or that their machinery and equipment is greater than $100,000,000 MXN.

- They were not notified of any tax penalty in the prior 24 months.

- To not have VAT refunds rejected for more than 20% of the authorized refunds and/or that said amount exceeds $5,000,000 MXN in the prior six months.

IMMEX Program Requirements

Inventory Management Software

As discussed earlier, one essential requirement for companies enrolled in the IMMEX program is the type of inventory management software they use. Maquiladoras in Mexico must use inventory software compliant with Annex 24 of the General Rules of Foreign Trade. For this, they have two options.

- Develop an in-house software compliant with Annex 24.

- Get a license for an existing software compliant with Annex 24.

Since only large companies have the means to develop their in-house software, most of the readers of this blog will go with the second option.

Why is a particular type of automated inventory software mandatory for IMMEX program-certified companies?

As discussed earlier in this article, the IMMEX program allows companies to import goods without paying taxes if they use them to manufacture a final product and export within a timeframe. For example, let us imagine that a company is importing fabric to manufacture jeans, and they have 18 months to export the jeans. The automated inventory software tracks the import of every batch of fabric and follows up until that batch has become jeans and has been shipped. So, at any given moment, you should be able to look at your inventory, track every imported batch’s status, and ensure the timeline is not exceeded.

Also, when a triangulation operation takes place (importing from a non-trade agreement country to export to a trade agreement country), the software helps track the imports with customs duty deferral until the export of the final product, when the customs duty must be paid.

Every year, companies enrolled in the IMMEX program must present their report on foreign trade operations. If the company uses the software correctly throughout the year, it will issue an accurate report for the representative to submit to the authority.

Conclusion

The IMMEX program is only one of the foreign trade incentive programs that the Mexican government has. It is aimed at manufacturing companies that export most of their production. The benefits companies get from the IMMEX program are to be able to import raw materials temporarily while they perform their manufacturing process so they can export the final product. The IMMEX program allows companies to produce, transform or repair goods to be exported.

The IMMEX program is heavily regulated, therefore, requires a lot of compliance. If you are looking to enroll your company as IMMEX, get in touch with us. We would be happy to assist you in the process.