Last updated on November 30th, 2023 at 11:24 am

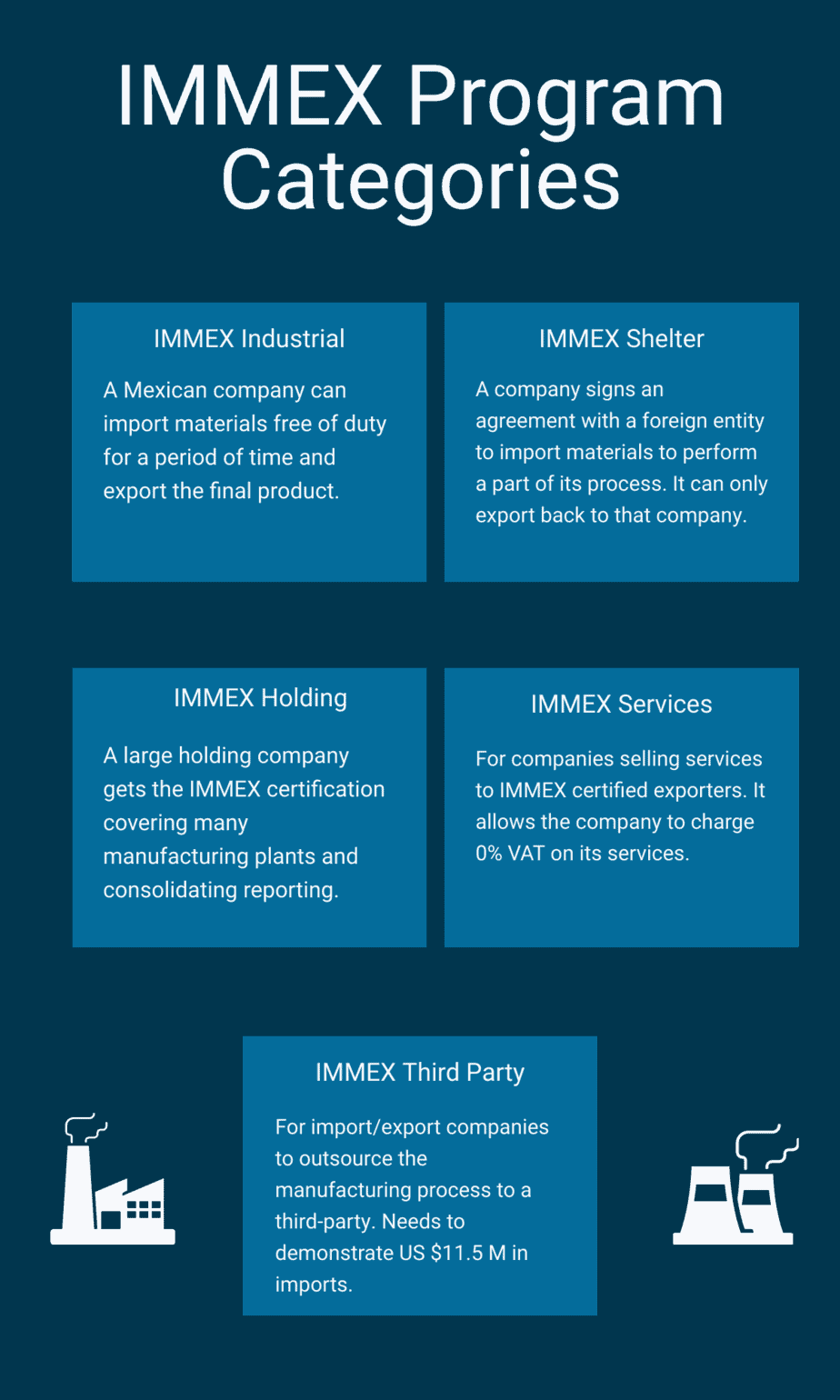

The IMMEX program is the legal framework that regulates maquiladoras in Mexico. It is one of the Foreign Trade Incentives Programs the Mexican government has implemented to make the country more competitive.

This comprehensive article discusses everything foreign manufacturers need to know about the IMMEX program and what maquiladoras in Mexico are about.

First, let us tackle the name. IMMEX stands for Industria Manufacturera, Maquiladora y de Servicios de Exportación; the literal translation gets tricky because of the word “Maquila.” For the last few days, I have been questioning my knowledge of Spanish while looking for a translation of this word into English. Technically, Maquila means “to perform a partial part of a production process,” although sometimes it is used interchangeably with “outsourcing.”

Now that we know that, we will use the term in Spanish throughout the article since there is no direct translation. So the IMMEX program is a manufacturing, maquila, and export services government program aimed at making Mexico more competitive internationally at attracting foreign investment. Maquiladoras in Mexico are companies that have enrolled in this program.

History Of Maquiladoras In Mexico

The Mexico-US border Maquiladoras in Mexico have a long history dating back to 1965 when the IMMEX program’s first predecessor was created. It was called the Northern Border Industrialization Program. The idea was to create jobs and strengthen the country’s trade balance by increasing net exports. This led to a boost in the northern border industrialization due to the transfer of technology from the US to Mexico. In the following decade, plenty of industrial parks were built in the border states of Sonora, Chihuahua, Coahuila, and Baja California.

In 1972, this program was extended to be valid in the entire country instead of just on the northern border. Also, further regulation was created to regulate maquiladoras in Mexico in the Customs Code, and INEGI, Mexico’s Statistics Institute, started to collect statistical information on it.

Maquiladoras in Mexico saw their most significant growth when Mexico joined the North American Free Trade Agreement in 1994. This growth set the foundation for the IMMEX program we know today, issued by decree in 2006.

IMMEX Program Overview

The IMMEX program allows Mexican companies to import products under a special customs regime called the “special regime for producing, transforming, or repairing merchandise.” This means your imports can enter the Mexican territory for a given time and cannot exceed this period before they are exported back. The IMMEX program only applies to manufacturing since the products imported must undergo one of the following processes.

- Production. When you import raw materials and submit them to a process that does not change their chemical properties. Tables, t-shirts, or whatever you can think of that does not chemically changes qualifies as production.

- Transformation. If there is a chemical process involved, a transformation takes place. The final product would be an entirely different substance than the imported one. Consider importing ingredients and turning them into a food product, like a cake.

- Repairing. IMMEX program also allows for repairing or refurbishing. If you import a TV to get repaired and export it after, you can get the program’s benefits.

What type of goods can be imported under the IMMEX program?

The IMMEX program allows companies to import everything they need to carry out an industrial manufacturing process.

- Raw materials, parts, or components.

- Fuels, lubricants, and other materials that are consumed in the process.

- Packaging, containers, labels, etc.

- Shipping containers and boxes.

- Machinery, equipment, tools, and any instrument involved in the process.

How long can the imported goods remain in Mexico?

Article 108 of the Mexican Customs Law states how long maquiladoras in Mexico can import goods through an IMMEX program.

- Up to 18 months for fuels, packaging, labels, containers, raw materials, parts, and components (the below exceptions apply).

- Up to 12 months for raw materials specified in Annex II of the IMMEX program decree.

- Up to two years, in the case of shipping containers and trailer containers.

- For as long as the company is enrolled in the IMMEX program for lubricants and goods consumed during the process (except fuels), pollution control equipment, laboratory equipment, management equipment, measurement equipment, and quality control equipment.

Annex II Of The IMMEX Program Decree

| Tariff Code | Goods |

|---|---|

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.4 but less than 99.5 degrees. |

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 96 but less than 99.4 degrees. |

| 1,701.12 | Sugar whose sucrose content by weight, in the dry state, has a polarization of less than 96 degrees. |

| 1,701.13 | Cane sugar referred to in Subheading Note 2 to this Chapter. |

| 1,701.14 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.4 but less than 99.5 degrees. |

| 1,701.14 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 96 but less than 99.4 degrees. |

| 1,701.91 | With added flavoring or coloring. |

| 1,701.99 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.5 but less than 99.7 degrees. |

| 1,701.99 | Sugar whose sucrose content by weight, in the dry state, has a polarization equal to or greater than 99.7 but less than 99.9 degrees. |

| 1,701.99 | Others. |

| 1,702.90 | Refined liquid sugar and invert sugar. |

| 1,702.90 | Others. |

| 1,806.10 | With a sugar content equal to or greater than 90% by weight. |

| 2,106.90 | Flavored or colored syrups. |

| 0.00 | |

| 7,201.10 | Unalloyed pig iron with a phosphorus content not exceeding 0.5% by weight. |

| 7,201.20 | Unalloyed pig iron with a phosphorus content exceeding 0.5% by weight. |

| 7,201.50 | Alloyed pig iron. |

| 7,201.50 | Others. |

| 7,202.11 | With a carbon content of more than 2% by weight. |

| 7,202.19 | Others. |

| 7,202.21 | Ferrosilicon-zirconium or ferrosilicon-manganese-zirconium. |

| 7,202.21 | Others. |

| 7,202.29 | Others. |

| 7,202.30 | Ferro-silico-manganese. |

| 7,202.41 | With a carbon content of more than 4% by weight. |

| 7,202.49 | Others. |

| 7,202.50 | Ferro-silico-chrome. |

| 7,202.60 | Ferronickel. |

| 7,202.70 | Ferromolybdenum. |

| 7,202.80 | Ferro-tungsten and ferro-silico-tungsten. |

| 7,202.91 | Ferrotitanium, encapsulated. |

| 7,202.91 | Ferro-silico-titanium. |

| 7,202.91 | Ferrotitanium, except as provided in 7202.91.01. |

| 7,202.92 | Ferrovanadium, encapsulated. |

| 7,202.92 | Others. |

| 7,202.93 | Ferroniobium. |

| 7,202.99 | Ferrocalcium-silicon, except those included in 7202.99.02. |

| 7,202.99 | Ferrocalcium, ferrocalcium-aluminum or ferrocalcium-silicon, encapsulated. |

| 7,202.99 | Ferrophosphorus; ferroboron. |

| 7,202.99 | Others. |

| 7,203.10 | Ferrous products obtained by direct reduction of iron ores. |

| 7,203.90 | Others. |

| 7,204.10 | Waste and scrap, foundry. |

| 7,204.21 | Stainless steel. |

| 7,204.29 | Others. |

| 7,204.30 | Waste and scrap, tinned iron or steel. |

| 7,204.41 | Turnings, shavings, chips, shavings, filings (from grinding, sawing, filing) and trimmings from stamping or cutting, whether or not in bundles. |

| 7,204.49 | Others. |

| 7,204.50 | Scrap ingots. |

| 7,205.10 | Shells. |

| 7,205.21 | Made of alloy steels. |

| 7,205.29 | Others. |

| 7,206.10 | Ingots. |

| 7,206.90 | Others. |

| 7,207.11 | Of square or rectangular cross section, whose width is less than twice the thickness. |

| 7,207.12 | With thickness less than or equal to 185 mm . |

| 7,207.12 | Others. |

| 7,207.19 | Others. |

| 7,207.20 | With thickness less than or equal to 185 mm, and width equal to or greater than twice the thickness. |

| 7,207.20 | Others. |

| 7,208.10 | Thicker than 10 mm . |

| 7,208.10 | Of a thickness greater than 4.75 mm but not exceeding 10 mm . |

| 7,208.10 | Others. |

| 7,208.25 | Thicker than 10 mm . |

| 7,208.25 | Others. |

| 7,208.26 | Of a thickness greater than or equal to 3 mm but less than 4.75 mm . |

| 7,208.27 | Thickness less than 3 mm . |

| 7,208.36 | Thicker than 10 mm . |

| 7,208.37 | Of a thickness greater than or equal to 4.75 mm but less than or equal to 10 mm . |

| 7,208.38 | Of a thickness greater than or equal to 3 mm but less than 4.75 mm . |

| 7,208.39 | Thickness less than 3 mm . |

| 7,208.40 | Thicker than 4.75 mm . |

| 7,208.40 | Others. |

| 7,208.51 | Of a thickness exceeding 10 mm, except 7208.51.02 and 7208.51.03. |

| 7,208.51 | Steel plates thicker than 10 mm, grades SHT-80, SHT-110, AR-400, SMM-400 or A-516. |

| 7,208.51 | Steel plates thicker than 70 mm, grade A-36. |

| 7,208.52 | Of a thickness greater than or equal to 4.75 mm but less than or equal to 10 mm . |

| 7,208.53 | Of a thickness greater than or equal to 3 mm but less than 4.75 mm . |

| 7,208.54 | Thickness less than 3 mm . |

| 7,208.90 | Others. |

| 7,209.15 | With a carbon content of more than 0.4 % by weight. |

| 7,209.15 | Steels whose yield strength is equal to or greater than 355 MPa. |

| 7,209.15 | Steels for porcelain coating on exposed parts. |

| 7,209.15 | Others. |

| 7,209.16 | Thicker than 1 mm but less than 3 mm . |

| 7,209.17 | Of a thickness greater than or equal to 0.5 mm but less than or equal to 1 mm . |

| 7,209.18 | Thickness less than 0.5 mm . |

| 7,209.25 | Of a thickness greater than or equal to 3 mm . |

| 7,209.26 | Thicker than 1 mm but less than 3 mm . |

| 7,209.27 | Of a thickness greater than or equal to 0.5 mm but less than or equal to 1 mm . |

| 7,209.28 | Thickness less than 0.5 mm . |

| 7,209.90 | Others. |

| 7,210.11 | Of a thickness greater than or equal to 0.5 mm . |

| 7,210.12 | With a thickness equal to or greater than 0.20 mm, whose first two digits of hardening code are “T2”, “T3”, “T4” and “T5”, according to the international standard ASTM A623 for simple reduced product, or its equivalent in other standards, except for what is included in fraction 7210.12.03. |

| 7,210.12 | Whose first two digits of the mechanical characteristics designation code are “DR”, according to the international standard ASTM A623 for double reduced product, or its equivalent in other standards. |

| 7,210.12 | Tinned sheets, with a thickness of 0.20 mm or more, of which the first two digits of the hardening code are “T2”, “T3”, “T4” and “T5”, recognizable as being designed exclusively for the manufacture of caps and bottoms for dry cell stacks. |

| 7,210.12 | Others. |

| 7,210.20 | Leaded, including those coated with an alloy of lead and tin. |

| 7,210.30 | Zinc-plated sheets on both sides. |

| 7,210.30 | Others. |

| 7,210.41 | Zinc-plated sheets on both sides. |

| 7,210.41 | Others. |

| 7,210.49 | Plate, plated or coated with zinc on both sides, except 7210.49.02, 7210.49.03 and 7210.49.04. |

| 7,210.49 | With a carbon content greater than 0.4% by weight. |

| 7,210.49 | Of a thickness of less than 3 mm, whose deformation resistance limit is equal to or greater than 275 MPa, or of a thickness equal to or greater than 3 mm, whose deformation resistance limit is equal to or greater than 355 MPa. |

| 7,210.49 | With a zinc content in the coating less than or equal to 50 gr/cm 2 . |

| 7,210.49 | Others. |

| 7,210.50 | With thickness equal to or greater than 0.20 mm, whose first two digits of hardening code are “T2”, “T3”, “T4” and “T5”, according to the international standard ASTM A623 for simple reduced product, or its equivalent in other standards. |

| 7,210.50 | Whose first two digits of the mechanical characteristics designation code are “DR”, according to the international standard ASTM A623 for double reduced product, or its equivalent in other standards. |

| 7,210.50 | Others. |

| 7,210.61 | Coated with aluminum and zinc alloys. |

| 7,210.69 | Coated with unalloyed aluminum, known as “aluminized”. |

| 7,210.69 | Others. |

| 7,210.70 | Painted sheets, zinc-plated on both sides. |

| 7,210.70 | Others. |

| 7,210.90 | Plated with stainless steel. |

| 7,210.90 | Others. |

| 7,211.13 | Rolled on four faces or in closed grooves, of a width exceeding 150 mm and a thickness of 4 mm or more, unrolled and without embossed motifs. |

| 7,211.14 | Strapping. |

| 7,211.14 | Hot rolled products (“sheets”), of a thickness of 4.75 mm or more but less than 12 mm . |

| 7,211.14 | Others. |

| 7,211.19 | Straps with thickness less than 4.75 mm . |

| 7,211.19 | Hot rolled (“sheets”), with a thickness of 1.9 mm or more, but less than 4.75 mm . |

| 7,211.19 | Coil slabs for sheet metal (“Coils”). |

| 7,211.19 | Hot rolled sheets, of a width of more than 500 mm . but less than 600 mm . and a thickness of 1.9 mm or more but less than 4.75 mm . |

| 7,211.19 | Others. |

| 7,211.23 | Strapping of thickness equal to or greater than 0.05 mm . |

| 7,211.23 | Cold rolled sheets, with a thickness greater than 0.46 mm but not exceeding 3.4 mm . |

| 7,211.23 | Others. |

| 7,211.29 | Straps of thickness equal to or greater than 0.05 mm with a carbon content of less than 0.6%. |

| 7,211.29 | Straps with a carbon content equal to or greater than 0.6%. |

| 7,211.29 | Cold rolled sheets, with a thickness greater than 0.46 mm but not exceeding 3.4 mm . |

| 7,211.29 | Others. |

| 7,211.90 | Others. |

| 7,212.10 | Tin-plated strips. |

| 7,212.10 | Tinplate or tinplate sheets (tinplate). |

| 7,212.10 | Others. |

| 7,212.20 | Strapping. |

| 7,212.20 | Zinc plated on both sides, width over 500 mm . |

| 7,212.20 | Others. |

| 7,212.30 | Strapping. |

| 7,212.30 | Zinc plated on both sides, width over 500 mm . |

| 7,212.30 | Others. |

| 7,212.40 | Coated sheets with silicone varnish. |

| 7,212.40 | Of a total thickness equal to or greater than 0.075 mm but not exceeding 0.55 mm with plastic coating on one or both sides. |

| 7,212.40 | Zinc plated on both sides, width over 500 mm . |

| 7,212.40 | Others. |

| 7,212.50 | Otherwise coated. |

| 7,212.60 | Unworked chrome-plated sheet metal. |

| 7,212.60 | Strips electrolytically copper plated on both sides and polished with a proportion of copper not exceeding 5%, with a width not exceeding 100 mm and a thickness not exceeding 0.6 mm . |

| 7,212.60 | Stainless steel plated plates. |

| 7,212.60 | Others. |

| 7,213.10 | With notches, cords, grooves or reliefs, produced in the laminate. |

| 7,213.20 | Others, of easily machined steel. |

| 7,213.91 | With a carbon content of less than 0.4% by weight. |

| 7,213.91 | With a carbon content equal to or greater than 0.4% by weight. |

| 7,213.99 | Steel wire rod with a maximum carbon content of 0.13%, a maximum silicon content of 0.1%, and a minimum aluminum content of 0.02%, by weight. |

| 7,213.99 | Others. |

| 7,214.10 | Forged. |

| 7,214.20 | Rebar or reinforcing bars for cement or concrete. |

| 7,214.20 | Others. |

| 7,214.30 | The others are made of easy-to-machine steel. |

| 7,214.91 | With a carbon content of less than 0.25% by weight. |

| 7,214.91 | With a carbon content of 0.25% or more but less than 0.6% by weight. |

| 7,214.91 | Others. |

| 7,214.99 | With a carbon content of less than 0.25% by weight. |

| 7,214.99 | With a carbon content of 0.25% or more but less than 0.6% by weight. |

| 7,214.99 | Others. |

| 7,215.10 | Made of easily machined steel, simply obtained or cold finished. |

| 7,215.50 | Solid, aluminum or copper clad. |

| 7,215.50 | Others. |

| 7,215.90 | Others. |

| 7,216.10 | U, I or H sections, not further worked than hot-rolled, hot-drawn or hot-extruded, less than 80 mm high. |

| 7,216.21 | L-shaped profiles. |

| 7,216.22 | T-profiles. |

| 7,216.31 | Whose thickness does not exceed 23 cm, except that included in fraction 7216.31.02. |

| 7,216.31 | Whose thickness is equal to or greater than 13 cm , without exceeding 20 cm . |

| 7,216.31 | Others. |

| 7,216.32 | Whose thickness does not exceed 23 cm, except that included in fraction 7216.32.02. |

| 7,216.32 | Whose thickness is equal to or greater than 13 cm , without exceeding 20 cm . |

| 7,216.32 | Others. |

| 7,216.33 | H-profiles. |

| 7,216.40 | L or T sections, not further worked than hot-rolled, hot-drawn or hot-extruded, of a height of 80 mm or more. |

| 7,216.50 | Z-shaped profiles, whose thickness does not exceed 23 cm . |

| 7,216.50 | Others. |

| 7,216.61 | Profiles in the shape of H, I, L, L, T, U and Z, whose thickness does not exceed 23 cm, except those included in fraction 7216.61.02. |

| 7,216.61 | U-shaped and I-shaped, whose thickness is equal to or greater than 13 cm , without exceeding 20 cm . |

| 7,216.61 | Others. |

| 7,216.69 | Profiles in the shape of H, I, L, L, T, U and Z, whose thickness does not exceed 23 cm, except those included in fraction 7216.69.02. |

| 7,216.69 | U-shaped and I-shaped, whose thickness is equal to or greater than 13 cm , without exceeding 20 cm . |

| 7,216.69 | Others. |

| 7,216.91 | Obtained or cold finished from flat rolled products. |

| 7,216.99 | Others. |

| 7,217.10 | Cold forged, with the largest cross section equal to or greater than 7 mm, but less than or equal to 28 mm, with a carbon content of less than 0.6% by weight. |

| 7,217.10 | Others. |

| 7,217.20 | Laminates, longitudinally joined together, recognizable as being designed exclusively for the manufacture of staples. |

| 7,217.20 | Others. |

| 7,217.30 | Copper plated, with a carbon content of less than 0.6%. |

| 7,217.30 | Others. |

| 7,217.90 | Others. |

| 7,218.10 | Ingots or other primary forms. |

| 7,218.91 | Rectangular cross section. |

| 7,218.99 | Others. |

| 7,219.11 | Thicker than 10 mm . |

| 7,219.12 | Thickness equal to or less than 6 mm and width equal to or greater than 710 mm, but not exceeding 1,350 mm. |

| 7,219.12 | Others. |

| 7,219.13 | Of a thickness greater than or equal to 3 mm but less than 4.75 mm . |

| 7,219.14 | Thickness less than 3 mm . |

| 7,219.21 | Thicker than 10 mm . |

| 7,219.22 | Of a thickness greater than or equal to 4.75 mm but less than or equal to 10 mm . |

| 7,219.23 | Of a thickness greater than or equal to 3 mm but less than 4.75 mm . |

| 7,219.24 | Thickness less than 3 mm . |

| 7,219.31 | Of a thickness greater than or equal to 4.75 mm . |

| 7,219.32 | Whose thickness does not exceed 4 mm . |

| 7,219.32 | Others. |

| 7,219.33 | Thicker than 1 mm but less than 3 mm . |

| 7,219.34 | Of a thickness greater than or equal to 0.5 mm but less than or equal to 1 mm . |

| 7,219.35 | Of a thickness equal to or greater than 0.3 mm . |

| 7,219.35 | Others. |

| 7,219.90 | Others. |

| 7,220.11 | Of a thickness greater than or equal to 4.75 mm . |

| 7,220.12 | Thickness less than 4.75 mm . |

| 7,220.20 | Untempered or pretempered (DGN-410, DGN-420 and DGN-440) with thickness equal to or greater than 0.3 mm , not exceeding 6.0 mm , and with a maximum width of 325 mm . |

| 7,220.20 | With a thickness equal to or greater than 0.3 mm, but not exceeding 4.0 mm, except that included in fraction 7220.20.01. |

| 7,220.20 | Others. |

| 7,220.90 | Others. |

| 7,221.00 | Stainless steel wire rod. |

| 7,222.11 | Nitrogen steel, hot rolled, peeled or ground. |

| 7,222.11 | Others. |

| 7,222.19 | Others. |

| 7,222.20 | Bars simply obtained or cold finished. |

| 7,222.30 | Hollow, for mine drilling. |

| 7,222.30 | Others. |

| 7,222.40 | Profiles. |

| 7,223.00 | Circular in cross section. |

| 7,223.00 | Others. |

| 7,224.10 | Tool grade steel ingots. |

| 7,224.10 | High-speed steel ingots. |

| 7,224.10 | Ingots, except those covered by 7224.10.01 and 7224.10.02. |

| 7,224.10 | Square or rectangular slabs (blooms) and tool grade steel billets. |

| 7,224.10 | Square or rectangular slabs (blooms) and high-speed steel billets. |

| 7,224.10 | Others. |

| 7,224.90 | Forgings, recognizable for the manufacture of seals or joints of drilling elements. |

| 7,224.90 | Intermediate products, with a carbon content lower or equal to 0.006% by weight. |

| 7,224.90 | Others. |

| 7,225.11 | Grain oriented. |

| 7,225.19 | Others. |

| 7,225.30 | Containing by weight 0.01% or less of carbon, and the following elements, considered individually or together: titanium between 0.02% and 0.15% by weight, niobium between 0.01% and 0.03% by weight. |

| 7,225.30 | With a boron content equal to or greater than 0.0008%, with a thickness greater than 10 mm . |

| 7,225.30 | With a boron content of 0.0008% or more, of a thickness of 4.75 mm or more, but not exceeding 10 mm . |

| 7,225.30 | With a boron content of 0.0008% or more, of a thickness of 3 mm or more, but less than 4.75 mm . |

| 7,225.30 | With a boron content equal to or greater than 0.0008%, with a thickness of less than 3 mm . |

| 7,225.30 | Made of high-speed steel. |

| 7,225.30 | Others. |

| 7,225.40 | With a boron content equal to or greater than 0.0008%, with a thickness greater than 10 mm . |

| 7,225.40 | With a boron content of 0.0008% or more, of a thickness of 4.75 mm or more, but not exceeding 10 mm . |

| 7,225.40 | With a boron content of 0.0008% or more, of a thickness of 3 mm or more, but less than 4.75 mm . |

| 7,225.40 | With a boron content equal to or greater than 0.0008%, with a thickness of less than 3 mm . |

| 7,225.40 | Made of high-speed steel. |

| 7,225.40 | Others. |

| 7,225.50 | With a boron content of 0.0008% or more, and a thickness of 3 mm or more, rolled. |

| 7,225.50 | With a boron content equal to or greater than 0.0008%, and thickness greater than 1 mm, but less than 3 mm, rolled. |

| 7,225.50 | With a boron content of 0.0008% or more, and a thickness of 0.5 mm or more, but not exceeding 1 mm, rolled. |

| 7,225.50 | With a boron content equal to or greater than 0.0008%, and thickness less than 0.5 mm, rolled. |

| 7,225.50 | With a boron content equal to or greater than 0.0008%, uncoiled. |

| 7,225.50 | Made of high-speed steel. |

| 7,225.50 | Others. |

| 7,225.91 | Electrolytically galvanized. |

| 7,225.92 | Otherwise, they are otherwise sealed. |

| 7,225.99 | Others. |

| 7,226.11 | Grain oriented. |

| 7,226.19 | Others. |

| 7,226.20 | Made of high-speed steel. |

| 7,226.91 | Of a width exceeding 500 mm, except 7226.91.02, 7226.91.03, 7226.91.04, 7226.91.05 and 7226.91.06. |

| 7,226.91 | With a boron content of 0.0008% or more, and a thickness of 3 mm or more, rolled. |

| 7,226.91 | With a boron content equal to or greater than 0.0008%, and thickness greater than 1 mm, but less than 3 mm, rolled. |

| 7,226.91 | With a boron content of 0.0008% or more, and a thickness of 0.5 mm or more, but not exceeding 1 mm, rolled. |

| 7,226.91 | With a boron content equal to or greater than 0.0008%, and thickness less than 0.5 mm, rolled. |

| 7,226.91 | With a boron content equal to or greater than 0.0008%, uncoiled. |

| 7,226.91 | Others. |

| 7,226.92 | With a boron content of 0.0008% or more, and a thickness of 3 mm or more, rolled. |

| 7,226.92 | With a boron content equal to or greater than 0.0008%, and thickness greater than 1 mm, but less than 3 mm, rolled. |

| 7,226.92 | With a boron content of 0.0008% or more, and a thickness of 0.5 mm or more, but not exceeding 1 mm, rolled. |

| 7,226.92 | With a boron content equal to or greater than 0.0008%, and thickness less than 0.5 mm, rolled. |

| 7,226.92 | With a boron content equal to or greater than 0.0008%, uncoiled. |

| 7,226.92 | Others. |

| 7,226.99 | Electrolytically galvanized. |

| 7,226.99 | Otherwise, they are otherwise sealed. |

| 7,226.99 | Others. |

| 7,227.10 | Made of high-speed steel. |

| 7,227.20 | Made of silico-manganese steel. |

| 7,227.90 | Tool grade steel. |

| 7,227.90 | Others. |

| 7,228.10 | Hot finished bars. |

| 7,228.10 | Others. |

| 7,228.20 | Hot finished bars. |

| 7,228.20 | Others. |

| 7,228.30 | In tool grade steels. |

| 7,228.30 | Others. |

| 7,228.40 | In tool grade steels. |

| 7,228.40 | Others. |

| 7,228.50 | In tool grade steels. |

| 7,228.50 | Others. |

| 7,228.60 | In tool grade steels. |

| 7,228.60 | Others. |

| 7,228.70 | Profiles. |

| 7,228.80 | Hollow rods for drilling. |

| 7,229.20 | Made of silico-manganese steel. |

| 7,229.90 | Coated with copper and treated or not with boron, with a diameter of 0.8 mm or less, suitable for the manufacture of electrodes for light bulb ignition cathodes, discharge tubes or cathode ray tubes. |

| 7,229.90 | Tool grade steel. |

| 7,229.90 | Oil tempered, of chromium-silicon and/or chromium-vanadium steel, with a carbon content of less than 1.3% by weight, and a diameter of 6.35 mm or less. |

| 7,229.90 | Made of high-speed steel. |

| 7,229.90 | Others. |

| 7,304.11 | Hot rolled tubes, not coated or other surface work, including varnished or lacquered hot rolled tubes: of outside diameter not exceeding 114.3 mm and wall thickness not exceeding 4 mm but not exceeding 19.5 mm . |

| 7,304.11 | Hot rolled tubes, not coated or other surface work, including varnished or lacquered hot rolled tubes: of outside diameter exceeding 114.3 mm but not exceeding 406.4 mm and wall thickness equal to or exceeding 6.35 mm but not exceeding 38.1 mm . |

| 7,304.11 | Hot-rolled tubes, not coated or other surface work, including varnished or lacquered hot-rolled tubes: of an outside diameter of 406.4 mm or more and a wall thickness of 9.52 mm or more but not exceeding 31.75 mm . |

| 7,304.11 | Cold rolled tubes, not coated or other surface work, including varnished or lacquered cold rolled tubes: of outside diameter not exceeding 114.3 mm and wall thickness not exceeding 1.27 mm but not exceeding 9.5 mm . |

| 7,304.11 | Semi-finished tubes or sketches for the exclusive use of cold drawn pipe manufacturing companies. |

| 7,304.11 | Others. |

| 7,304.19 | Hot rolled tubes, not coated or other surface work, including varnished or lacquered hot rolled tubes: of an external diameter not exceeding 114.3 mm and a wall thickness not exceeding 4 mm but not exceeding 19.5 mm . |

| 7,304.19 | Hot rolled tubes, not coated or other surface work, including varnished or lacquered hot rolled tubes: of outside diameter exceeding 114.3 mm but not exceeding 406.4 mm and wall thickness equal to or exceeding 6.35 mm but not exceeding 38.1 mm . |

| 7,304.19 | Hot-rolled tubes, not coated or other surface work, including varnished or lacquered hot-rolled tubes: of an outside diameter of 406.4 mm or more and a wall thickness of 9.52 mm or more but not exceeding 31.75 mm . |

| 7,304.19 | Cold rolled tubes, not coated or other surface work, including varnished or lacquered cold rolled tubes: of an outside diameter not exceeding 114.3 mm and a wall thickness not exceeding 1.27 mm and not exceeding 9.5 mm . |

| 7,304.19 | Semi-finished tubes or sketches for the exclusive use of cold drawn pipe manufacturing companies. |

| 7,304.19 | Others. |

| 7,304.23 | Drill pipe, hot rolled, with an outside diameter of 60.3 mm or more but not exceeding 168.3 mm, with threaded ends. |

| 7,304.29 | Casing pipes, hot-rolled, with threaded ends, of an outside diameter of 114.3 mm or more but not exceeding 346.1 mm . |

| 7,304.29 | Casing pipes, hot-rolled, with threaded ends, of an outside diameter of 460.4 mm or more but not exceeding 508 mm . |

| 7,304.29 | Casing pipe, hot-rolled, unthreaded, of an outside diameter of 114.3 mm or more but not exceeding 346.1 mm . |

| 7,304.29 | Casing pipes, hot rolled, unthreaded, of an outside diameter of 460.4 mm or more but not exceeding 508 mm . |

| 7,304.29 | Tubing, hot-rolled, threaded, of an outside diameter not exceeding 114.3 mm . |

| 7,304.29 | Tubing, hot-rolled, not threaded, of an outside diameter not exceeding 114.3 mm . |

| 7,304.29 | Others. |

| 7,304.31 | So-called “mechanical” or “structural” pipes, without coatings or other surface work, of an outside diameter not exceeding 114.3 mm and a wall thickness of 1.27 mm or more but not exceeding 9.5 mm . |

| 7,304.31 | Hollow bars with an outside diameter greater than 30 mm but not exceeding 50 mm . |

| 7,304.31 | Hollow bars with outside diameter greater than 50 mm . |

| 7,304.31 | Coils. |

| 7,304.31 | Finned or flanged tubes. |

| 7,304.31 | Made of carbon steel, with a diameter greater than 120 mm . |

| 7,304.31 | So-called “thermal” or “conduction” pipes, without coatings or other surface work, of an outside diameter not exceeding 114.3 mm and a wall thickness of 1.27 mm or more but not exceeding 9.5 mm . |

| 7,304.31 | Others. |

| 7,304.39 | Hot-rolled “mechanical” or “structural” tubes and pipes, not coated or surface-worked, including hot-rolled, lacquered or varnished “mechanical” or “structural” tubes: of an external diameter not exceeding 114.3 mm, and a wall thickness not exceeding 4 mm but not exceeding 19.5 mm. |

| 7,304.39 | Hot-rolled “mechanical” or “structural” tubing, not coated or otherwise surface-worked, including hot-rolled, lacquered or varnished “mechanical” or “structural” tubing: of an outside diameter exceeding 114.3 mm but not exceeding 355.6 mm and a wall thickness of 6.35 mm or more but not exceeding 38.1 mm . |

| 7,304.39 | Hot-rolled hollow bars, with an outside diameter exceeding 30 mm but not exceeding 50 mm, as well as those with an outside diameter exceeding 300 mm. |

| 7,304.39 | Hot-rolled hollow bars, of an outside diameter exceeding 50 mm but not exceeding 300 mm . |

| 7,304.39 | Thermal” or “conduction” tubes, without coating or surface work, including lacquered or varnished “thermal” or “conduction” tubes: of an external diameter not exceeding 114.3 mm and a wall thickness not exceeding 4 mm, but not exceeding 19.5 mm. |

| 7,304.39 | Thermal” or “conduction” tubes, without coating or other surface work, including lacquered or varnished “thermal” or “conduction” tubes: of an outside diameter greater than 114.3 mm but not exceeding 406.4 mm and a wall thickness equal to or greater than 6.35 mm but not exceeding 38.1 mm. |

| 7,304.39 | Thermal” or “conduction” tubes, without coating or other surface work, including lacquered or varnished “thermal” or “conduction” tubes: of an external diameter of 406.4 mm or more and a wall thickness of 9.52 mm or more but not exceeding 31.75 mm. |

| 7,304.39 | Finned or flanged tubes. |

| 7,304.39 | Semi-finished tubes or sketches, without coating or other surface work, of an outside diameter of 20 mm or more but not exceeding 460 mm and a wall thickness of 2.8 mm or more but not exceeding 35.4 mm , with plain, beveled, upset and/or threaded ends and coupling. |

| 7,304.39 | Others. |

| 7,304.41 | Others. |

| 7,304.49 | Others. |

| 7,304.51 | Others. |

| 7,304.59 | So-called “mechanical” or “structural” tubes without coating or other surface work, including lacquered or varnished “mechanical” or “structural” tubes: of an outside diameter not exceeding 114.3 mm and a wall thickness of 4 mm or more but not exceeding 19.5 mm . |

| 7,304.59 | So-called “mechanical” or “structural” tubes, without coating or other surface work, including lacquered or varnished “mechanical” or “structural” tubes: of outside diameter greater than 114.3 mm but not exceeding 355.6 mm and wall thickness equal to or greater than 6.35 mm but not exceeding 38.1 mm . |

| 7,304.59 | Hollow bars with an outside diameter greater than 30 mm but not exceeding 50 mm, as well as those with an outside diameter greater than 300 mm. |

| 7,304.59 | Hollow bars with an outside diameter greater than 50 mm but not exceeding 300 mm . |

| 7,304.59 | Thermal” or “conduction” tubes, without coating or other work, including lacquered or varnished “thermal” or “conduction” tubes: of an external diameter not exceeding 114.3 mm and a wall thickness of 4 mm or more but not exceeding 19.5 mm . |

| 7,304.59 | Thermal” or “conduction” tubes, without coating or other surface work, including lacquered or varnished “thermal” or “conduction” tubes: of an outside diameter greater than 114.3 mm but not exceeding 406.4 mm and a wall thickness equal to or greater than 6.35 mm but not exceeding 38.1 mm. |

| 7,304.59 | Thermal” or “conduction” tubes, without coating or other surface work, including lacquered or varnished “thermal” or “conduction” tubes: of an external diameter of 406.4 mm or more and a wall thickness of 9.52 mm or more but not exceeding 31.75 mm. |

| 7,304.59 | Others. |

| 7,304.90 | Others. |

| 7,306.19 | Others. |

| 7,306.30 | Galvanized, except as provided for in 7306.30.02. |

| 7,306.30 | Others. |

| 7,306.61 | Square or rectangular section. |

| 7,307.93 | Butt welding accessories. |

| 7,312.10 | Galvanized, with a diameter greater than 4 mm, consisting of more than 5 wires and with untwisted cores of the same material, except those included in fraction 7312.10.07. |

| 7,312.10 | Made of non-galvanized steel, covered by a layer of coupled wires of “Z” profile, with diameter less than or equal to 60 mm. |

| 7,312.10 | Flexible cable (Bowden cable) consisting of copper-plated steel wires spirally wound on a core of the same material, with a diameter of 5 mm or less. |

| 7,312.10 | Made of brass-plated steel, exclusively recognizable for the manufacture of tires. |

| 7,312.10 | Of uncoated steel, whether or not lubricated, except those covered by 7312.10.08. |

| 7,312.10 | Galvanized, with a diameter of less than 1.6 mm, consisting of 9 or more strands with a diameter of less than 0.18 mm, twisted in S or Z direction. |

| 7,312.10 | Galvanized, with a diameter greater than 4 mm but less than 19 mm, consisting of 7 wires, lubricated or unlubricated. |

| 7,312.10 | Ungalvanized, with a diameter less than or equal to 19 mm, consisting of 7 wires. |

| 7,312.10 | Braided or twisted, less than 500 m long, with metallic attachments at the ends. |

| 7,312.10 | Plasticized cables. |

| 7,312.10 | Others. |

| 7,312.90 | Others. |

| 7,313.00 | Barbed wire, of iron or steel; wire (single or double) and string, twisted, whether or not barbed, of iron or steel, of a kind used for fencing. |

| 7,314.19 | Of wire of circular cross-section, except 7314.19.01 and 7314.19.03. |

| 7,314.19 | Zinc plated. |

| 7,314.19 | Others. |

| 7,314.20 | Nets and grids, welded at the crossing points, made of wire whose largest cross-sectional dimension is greater than or equal to 3 mm and with a mesh area greater than or equal to 100 cm². |

| 7,314.31 | Zinc plated. |

| 7,314.39 | Others. |

| 7,314.41 | Zinc plated. |

| 7,314.42 | Plastic coated. |

| 7,314.49 | Others. |

| 7,314.50 | Sheets and strips, extended (unfolded). |

| 7,315.82 | Weighing less than 15 kg per linear meter, extended, except for that included in 7315.82.01. |

| 7,315.82 | Others. |

| 7,315.89 | Weighing less than 15 kg/m, except 7315.89.01. |

| 7,315.89 | Others. |

| 7,317.00 | Nails for horseshoeing. |

| 7,317.00 | Others. |

| 0.00 | |

| 5,001.00 | Silk cocoons suitable for reeling. |

| 5,002.00 | Raw silk (untwisted). |

| 5,003.00 | No backcombing or combing. |

| 5,003.00 | Others. |

| 5,004.00 | Silk yarn (other than yarn spun from silk waste) not put up for retail sale. |

| 5,005.00 | Silk waste yarn, not put up for retail sale. |

| 5,006.00 | Silk yarn, or yarn spun from silk waste, put up for retail sale; “Messina hair” (“Florentine horsehair”). |

| 5,007.10 | Tassel fabrics. |

| 5,007.20 | Other fabrics containing 85% or more by weight of silk or silk waste other than flock. |

| 5,007.90 | Other fabrics. |

| 5,101.11 | With a fiber yield equal to or less than 75%. |

| 5,101.11 | Others. |

| 5,101.19 | With a fiber yield equal to or less than 75%. |

| 5,101.19 | Others. |

| 5,101.21 | With a fiber yield equal to or less than 75%. |

| 5,101.21 | Others. |

| 5,101.29 | With a fiber yield equal to or less than 75%. |

| 5,101.29 | Others. |

| 5,101.30 | With a fiber yield equal to or less than 75%. |

| 5,101.30 | Others. |

| 5,102.11 | Kashmir goat. |

| 5,102.19 | Angora goat (mohair). |

| 5,102.19 | Rabbit or hare. |

| 5,102.19 | Others. |

| 5,102.20 | Common goat. |

| 5,102.20 | Others. |

| 5,103.10 | Wool, from combing machines (“blousses”). |

| 5,103.10 | Of clean wool, except from combing machines (“blousses”). |

| 5,103.10 | Others. |

| 5,103.20 | Wool, from combing machines (“blousses”). |

| 5,103.20 | Of clean wool, except from combing machines (“blousses”). |

| 5,103.20 | Others. |

| 5,103.30 | Ordinary hair waste. |

| 5,104.00 | Yarns of wool or of fine or ordinary hair. |

| 5,105.10 | Carded wool. |

| 5,105.21 | “Bulk combed wool”. |

| 5,105.29 | Hairstyles in strands (“tops”). |

| 5,105.29 | Others. |

| 5,105.31 | Kashmir goat. |

| 5,105.39 | Made of alpaca, vicuña and llama, combed in strands (“tops”). |

| 5,105.39 | Of guanaco combed in strands (“tops”). |

| 5,105.39 | Others. |

| 5,105.40 | Ordinary hair, carded or combed. |

| 5,106.10 | With a wool content of 85% or more by weight. |

| 5,106.20 | With a wool content of less than 85% by weight. |

| 5,107.10 | With a wool content of 85% or more by weight. |

| 5,107.20 | With a wool content of less than 85% by weight. |

| 5,108.10 | Carding. |

| 5,108.20 | Hairstyle. |

| 5,109.10 | Containing 85% or more by weight of wool or fine hair. |

| 5,109.90 | Others. |

| 5,110.00 | Yarn of coarse animal hair or horsehair (including gimped horsehair yarn), whether or not put up for retail sale. |

| 5,111.11 | Of the type used for upholstery and tapestry, hand-woven fabrics. |

| 5,111.11 | Others. |

| 5,111.19 | Of the type used for upholstery and tapestry, hand-woven fabrics. |

| 5,111.19 | Others. |

| 5,111.20 | Of the type used for upholstery and tapestry. |

| 5,111.20 | Others. |

| 5,111.30 | Of the type used for upholstery and tapestry. |

| 5,111.30 | Others. |

| 5,111.90 | Others. |

| 5,112.11 | Of the type used for upholstery and tapestry. |

| 5,112.11 | Others. |

| 5,112.19 | Of the type used for upholstery and tapestry. |

| 5,112.19 | Billiard cloth. |

| 5,112.19 | Others. |

| 5,112.20 | Of the type used for upholstery and tapestry. |

| 5,112.20 | Others. |

| 5,112.30 | Of the type used for upholstery and tapestry. |

| 5,112.30 | Billiard cloth. |

| 5,112.30 | Others. |

| 5,112.90 | Others. |

| 5,113.00 | Ordinary hair. |

| 5,113.00 | Others. |

| 5,201.00 | With nugget. |

| 5,201.00 | Seedless, fiber with more than 29 mm in length. |

| 5,201.00 | Others. |

| 5,202.10 | Yarn waste. |

| 5,202.91 | Lint. |

| 5,202.99 | Delete. |

| 5,202.99 | Others. |

| 5,203.00 | Carded or combed cotton. |

| 5,204.11 | Containing 85% or more by weight of cotton. |

| 5,204.19 | Others. |

| 5,204.20 | Conditioned for retail sale. |

| 5,205.11 | Titer greater than or equal to 714.29 decitex (less than or equal to metric number 14). |

| 5,205.12 | Less than 714.29 decitex but greater than or equal to 232.56 decitex (greater than metric number 14 but less than or equal to metric number 43). |

| 5,205.13 | Less than 232.56 decitex but greater than or equal to 192.31 decitex (greater than metric number 43 but less than or equal to metric number 52). |

| 5,205.14 | Less than 192.31 decitex but greater than or equal to 125 decitex (greater than metric number 52 but less than or equal to metric number 80). |

| 5,205.15 | Titer less than 125 decitex (greater than metric number 80). |

| 5,205.21 | Titer greater than or equal to 714.29 decitex (less than or equal to metric number 14). |

| 5,205.22 | Less than 714.29 decitex but greater than or equal to 232.56 decitex (greater than metric number 14 but less than or equal to metric number 43). |

| 5,205.23 | Less than 232.56 decitex but greater than or equal to 192.31 decitex (greater than metric number 43 but less than or equal to metric number 52). |

| 5,205.24 | Less than 192.31 decitex but greater than or equal to 125 decitex (greater than metric number 52 but less than or equal to metric number 80). |

| 5,205.26 | Of less than 125 decitex but greater than or equal to 106.38 decitex (greater than metric number 80 but less than or equal to metric number 94). |

| 5,205.27 | With a titer of less than 106.38 decitex but greater than or equal to 83.33 decitex (greater than metric number 94 but less than or equal to metric number 120). |

| 5,205.28 | Titer less than 83.33 decitex (greater than metric number 120). |

| 5,205.31 | Of a count greater than or equal to 714.29 decitex per single yarn (less than or equal to metric number 14 per single yarn). |

| 5,205.32 | Of count less than 714.29 decitex but greater than or equal to 232.56 decitex, per single yarn (greater than metric number 14 but less than or equal to metric number 43, per single yarn). |

| 5,205.33 | Of count less than 232.56 decitex but greater than or equal to 192.31 decitex, per single yarn (greater than metric number 43 but less than or equal to metric number 52, per single yarn). |

| 5,205.34 | Of count less than 192.31 decitex but greater than or equal to 125 decitex, per single yarn (greater than metric number 52 but less than or equal to metric number 80, per single yarn). |

| 5,205.35 | Less than 125 decitex per single yarn (greater than metric number 80 per single yarn). |

| 5,205.41 | Of a count greater than or equal to 714.29 decitex per single yarn (less than or equal to metric number 14 per single yarn). |

| 5,205.42 | Of count less than 714.29 decitex but greater than or equal to 232.56 decitex, per single yarn (greater than metric number 14 but less than or equal to metric number 43, per single yarn). |

| 5,205.43 | Of count less than 232.56 decitex but greater than or equal to 192.31 decitex, per single yarn (greater than metric number 43 but less than or equal to metric number 52, per single yarn). |

| 5,205.44 | Of count less than 192.31 decitex but greater than or equal to 125 decitex, per single yarn (greater than metric number 52 but less than or equal to metric number 80, per single yarn). |

| 5,205.46 | Of count less than 125 decitex but greater than or equal to 106.38 decitex, per single yarn (greater than metric number 80 but less than or equal to metric number 94, per single yarn). |

| 5,205.47 | Of count less than 106.38 decitex but greater than or equal to 83.33 decitex, per single yarn (greater than metric number 94 but less than or equal to metric number 120, per single yarn). |

| 5,205.48 | Less than 83.33 decitex per single yarn (greater than metric number 120 per single yarn). |

| 5,206.11 | Titer greater than or equal to 714.29 decitex (less than or equal to metric number 14). |

| 5,206.12 | Less than 714.29 decitex but greater than or equal to 232.56 decitex (greater than metric number 14 but less than or equal to metric number 43). |

| 5,206.13 | Less than 232.56 decitex but greater than or equal to 192.31 decitex (greater than metric number 43 but less than or equal to metric number 52). |

| 5,206.14 | Less than 192.31 decitex but greater than or equal to 125 decitex (greater than metric number 52 but less than or equal to metric number 80). |

| 5,206.15 | Titer less than 125 decitex (greater than metric number 80). |

| 5,206.21 | Titer greater than or equal to 714.29 decitex (less than or equal to metric number 14). |

| 5,206.22 | Less than 714.29 decitex but greater than or equal to 232.56 decitex (greater than metric number 14 but less than or equal to metric number 43). |

| 5,206.23 | Less than 232.56 decitex but greater than or equal to 192.31 decitex (greater than metric number 43 but less than or equal to metric number 52). |

| 5,206.24 | Less than 192.31 decitex but greater than or equal to 125 decitex (greater than metric number 52 but less than or equal to metric number 80). |

| 5,206.25 | Titer less than 125 decitex (greater than metric number 80). |

| 5,206.31 | Of a count greater than or equal to 714.29 decitex per single yarn (less than or equal to metric number 14 per single yarn). |

| 5,206.32 | Of count less than 714.29 decitex but greater than or equal to 232.56 decitex, per single yarn (greater than metric number 14 but less than or equal to metric number 43, per single yarn). |

| 5,206.33 | Of count less than 232.56 decitex but greater than or equal to 192.31 decitex, per single yarn (greater than metric number 43 but less than or equal to metric number 52, per single yarn). |

| 5,206.34 | Of count less than 192.31 decitex but greater than or equal to 125 decitex, per single yarn (greater than metric number 52 but less than or equal to metric number 80, per single yarn). |

| 5,206.35 | Less than 125 decitex per single yarn (greater than metric number 80 per single yarn). |

| 5,206.41 | Of a count greater than or equal to 714.29 decitex single yarn (less than or equal to metric number 14 per single yarn). |

| 5,206.42 | Of count less than 714.29 decitex but greater than or equal to 232.56 decitex, per single yarn (greater than metric number 14 but less than or equal to metric number 43, per single yarn). |

| 5,206.43 | Of count less than 232.56 decitex but greater than or equal to 192.31 decitex, per single yarn (greater than metric number 43 but less than or equal to metric number 52, per single yarn). |

| 5,206.44 | Of count less than 192.31 decitex but greater than or equal to 125 decitex, per single yarn (greater than metric number 52 but less than or equal to metric number 80, per single yarn). |

| 5,206.45 | Less than 125 decitex per single yarn (greater than metric number 80 per single yarn). |

| 5,207.10 | Containing 85% or more by weight of cotton. |

| 5,207.90 | Others. |

| 5,208.11 | Of taffeta weave, weighing 100 g/m² or less. |

| 5,208.12 | Taffeta weave, weighing more than 100 g/m². |

| 5,208.13 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,208.19 | Twill weave. |

| 5,208.19 | With a cotton content equal to 100%, of a weight not exceeding 50 g/m² and a width not exceeding 1.50 m . |

| 5,208.19 | Others. |

| 5,208.21 | Of taffeta weave, weighing 100 g/m² or less. |

| 5,208.22 | Taffeta weave, weighing more than 100 g/m². |

| 5,208.23 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,208.29 | Twill weave. |

| 5,208.29 | Others. |

| 5,208.31 | Of taffeta weave, weighing 100 g/m² or less. |

| 5,208.32 | Taffeta weave, weighing more than 100 g/m². |

| 5,208.33 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,208.39 | Twill weave. |

| 5,208.39 | Others. |

| 5,208.41 | Of taffeta weave, weighing 100 g/m² or less. |

| 5,208.42 | Taffeta weave, weighing more than 100 g/m². |

| 5,208.43 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,208.49 | Other fabrics. |

| 5,208.51 | Of taffeta weave, weighing 100 g/m² or less. |

| 5,208.52 | Taffeta weave, weighing more than 100 g/m². |

| 5,208.59 | Twill weave, of course superior to 4. |

| 5,208.59 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,208.59 | Others. |

| 5,209.11 | Taffeta weave. |

| 5,209.12 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,209.19 | Twill weave. |

| 5,209.19 | Others. |

| 5,209.21 | Taffeta weave. |

| 5,209.22 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,209.29 | Twill weave. |

| 5,209.29 | Others. |

| 5,209.31 | Taffeta weave. |

| 5,209.32 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,209.39 | Twill weave. |

| 5,209.39 | Others. |

| 5,209.41 | Taffeta weave. |

| 5,209.42 | In which the warp yarns are dyed blue and the weft yarns are unbleached, bleached, dyed gray or colored lighter blue than the warp yarns. |

| 5,209.42 | Others. |

| 5,209.43 | Other twill weave fabrics, including cross weave, of a course of 4 or less. |

| 5,209.49 | Other fabrics. |

| 5,209.51 | Taffeta weave. |

| 5,209.52 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,209.59 | Twill weave. |

| 5,209.59 | Others. |

| 5,210.11 | Plain woven fabrics, in rolls up to 225 cm wide, with 100% cotton in the weft and 100% rayon in the warp. |

| 5,210.11 | Others. |

| 5,210.19 | Twill weave, of course superior to 4. |

| 5,210.19 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,210.19 | Others. |

| 5,210.21 | Taffeta weave. |

| 5,210.29 | Twill weave, of course superior to 4. |

| 5,210.29 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,210.29 | Others. |

| 5,210.31 | Taffeta weave. |

| 5,210.32 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,210.39 | Twill weave. |

| 5,210.39 | Others. |

| 5,210.41 | Taffeta weave. |

| 5,210.49 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,210.49 | Others. |

| 5,210.51 | Taffeta weave. |

| 5,210.59 | Twill weave, of course superior to 4. |

| 5,210.59 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,210.59 | Others. |

| 5,211.11 | Plain woven fabrics, in rolls up to 225 cm wide, with 100% cotton in the weft and 100% rayon in the warp. |

| 5,211.11 | Others. |

| 5,211.12 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,211.19 | Twill weave. |

| 5,211.19 | Others. |

| 5,211.20 | Taffeta weave. |

| 5,211.20 | Twill weave, of course superior to 4. |

| 5,211.20 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,211.20 | Others. |

| 5,211.31 | Taffeta weave. |

| 5,211.32 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,211.39 | Twill weave. |

| 5,211.39 | Others. |

| 5,211.41 | Taffeta weave. |

| 5,211.42 | In which the warp yarns are dyed blue and the weft yarns are unbleached, bleached, dyed gray or colored lighter blue than the warp yarns. |

| 5,211.42 | Others. |

| 5,211.43 | Other twill weave fabrics, including cross weave, of a course of 4 or less. |

| 5,211.49 | Other fabrics. |

| 5,211.51 | Taffeta weave. |

| 5,211.52 | Of twill weave, including cross weave, of course less than or equal to 4. |

| 5,211.59 | Twill weave. |

| 5,211.59 | Others. |

| 5,212.11 | Raw. |

| 5,212.12 | Bleached. |

| 5,212.13 | Dyed. |

| 5,212.14 | With yarns of different colors. |

| 5,212.15 | Prints. |

| 5,212.21 | Raw. |

| 5,212.22 | Bleached. |

| 5,212.23 | Dyed. |

| 5,212.24 | Denim type. |

| 5,212.24 | Others. |

| 5,212.25 | Prints. |

| 5,301.10 | Rough or retted flax. |

| 5,301.21 | Agramado or espadado. |

| 5,301.29 | Others. |

| 5,301.30 | Tow and linen waste. |

| 5,302.10 | Raw or retted hemp. |

| 5,302.90 | Others. |

| 5,303.10 | Jute and other textile bast fibers, raw or retted. |

| 5,303.90 | Others. |

| 5,305.00 | Of coconut, raw. |

| 5,305.00 | Coconut fibers, except those covered by 5305.00.01. |

| 5,305.00 | Abaca, raw. |

| 5,305.00 | Abaca fibers, except those covered by fraction 5305.00.03. |

| 5,305.00 | Sisal and other textile fibers of the genus Agave, raw. |

| 5,305.00 | Sisal and other textile fibers of the genus Agave, processed but not spun: tow and waste of these fibers (including yarn waste and garnetted stock). |

| 5,305.00 | Other raw textile fibers. |

| 5,305.00 | Others. |

| 5,306.10 | Simple. |

| 5,306.20 | Twisted or wired. |

| 5,307.10 | Simple. |

| 5,307.20 | Twisted or wired. |

| 5,308.10 | Coconut yarn. |

| 5,308.20 | Hemp yarn. |

| 5,308.90 | De ramio. |

| 5,308.90 | Paper yarns. |

| 5,308.90 | Others. |

| 5,309.11 | Raw or bleached. |

| 5,309.19 | Others. |

| 5,309.21 | Raw or bleached. |

| 5,309.29 | Others. |

| 5,310.10 | Raw. |

| 5,310.90 | Others. |

| 5,311.00 | Of ramie or paper yarn. |

| 5,311.00 | Others. |

| 5,401.10 | Made of synthetic filaments. |

| 5,401.20 | Made of artificial filaments. |

| 5,402.11 | Aramid. |

| 5,402.19 | Of nylon filaments, high tenacity, single, flat, flat, tensioned to the maximum, produced with a twist not exceeding 40 turns per meter. |

| 5,402.19 | Others. |

| 5,402.20 | Single, flat, tensioned to the maximum, produced with a twist not exceeding 40 turns per meter. |

| 5,402.20 | Others. |

| 5,402.31 | Of nylon or other polyamides, measuring 50 tex or less, single yarn. |

| 5,402.32 | Of nylon or other polyamides, measuring more than 50 tex, single yarn. |

| 5,402.33 | Of polyesters. |

| 5,402.34 | Made of polypropylene. |

| 5,402.39 | Polyvinyl alcohol. |

| 5,402.39 | Others. |

| 5,402.44 | Of polyurethane, of the so-called “elastane” type, untwisted, not on warp spools (in jumbo spools). |

| 5,402.44 | Others. |

| 5,402.45 | Nylon filament yarn, other than those of 5402.45.02 and 5402.45.04. |

| 5,402.45 | Of 44.4 decitex (40 deniers) and 34 filaments, except those of 5402.45.03 and 5402.45.04. |

| 5,402.45 | Aramid. |

| 5,402.45 | Made of partially oriented nylon filaments. |

| 5,402.45 | Others. |

| 5,402.46 | Other, of partially oriented polyesters. |

| 5,402.47 | Made entirely of polyester, with a count of 75 decitex or more but not exceeding 80 decitex, and 24 filaments per yarn. |

| 5,402.47 | Of polyester filaments, single, flat, tensioned to the maximum, produced with a twist not exceeding 40 turns per meter. |

| 5,402.47 | Others. |

| 5,402.48 | Polyolefin. |

| 5,402.48 | Made of fibrillated polypropylene. |

| 5,402.48 | Others. |

| 5,402.49 | Polyurethane, from 44.4 to 1887 decitex (40 to 1700 deniers). |

| 5,402.49 | Of polyurethanes, except those of 5402.49.01. |

| 5,402.49 | Made of acrylic or modacrylic fibers. |

| 5,402.49 | Polyvinyl alcohol. |

| 5,402.49 | Made of polytetrafluoroethylene. |

| 5,402.49 | Others. |

| 5,402.51 | Made of aramid fibers. |

| 5,402.51 | Others. |

| 5,402.52 | Of 75.48 decitex (68 deniers), dyed in bright rigid with 32 filaments and in twist of 800 turns per meter. |

| 5,402.52 | Made entirely of polyester, with a count of 75 decitex or more but not exceeding 80 decitex, and 24 filaments per yarn. |

| 5,402.52 | Others. |

| 5,402.59 | Polyolefin. |

| 5,402.59 | Made of acrylic or modacrylic fibers. |

| 5,402.59 | Polyvinyl alcohol. |

| 5,402.59 | Made of polytetrafluoroethylene. |

| 5,402.59 | Made of fibrillated polypropylene. |

| 5,402.59 | Others. |

| 5,402.61 | Made of aramid fibers. |

| 5,402.61 | Others. |

| 5,402.62 | Of 75.48 decitex (68 deniers), dyed in bright rigid with 32 filaments and a twist of 800 turns per meter. |

| 5,402.62 | Others. |

| 5,402.69 | Polyolefin. |

| 5,402.69 | Made of acrylic or modacrylic fibers. |

| 5,402.69 | Polyvinyl alcohol. |

| 5,402.69 | Made of polytetrafluoroethylene. |

| 5,402.69 | Made of fibrillated polypropylene. |

| 5,402.69 | Others. |

| 5,403.10 | High tenacity viscose rayon yarns. |

| 5,403.31 | Of viscose rayon, untextured, untwisted or with a twist of 120 turns per meter or less. |

| 5,403.31 | Made of textured yarns. |

| 5,403.32 | Of viscose rayon, untextured, with a twist greater than 120 turns per meter. |

| 5,403.32 | Made of textured yarns. |

| 5,403.33 | Made of cellulose acetate. |

| 5,403.39 | Made of textured yarns. |

| 5,403.39 | Others. |

| 5,403.41 | Non-textured viscose rayon. |

| 5,403.41 | Made of textured yarns. |

| 5,403.42 | Made of cellulose acetate. |

| 5,403.49 | Made of textured yarns. |

| 5,403.49 | Others. |

| 5,404.11 | Of polyurethanes, of the type known as “elastanes”. |

| 5,404.11 | Others. |

| 5,404.12 | Polyolefin. |

| 5,404.12 | Others. |

| 5,404.19 | Polyester. |

| 5,404.19 | Made of polyamides or superpolyamides. |

| 5,404.19 | Polyvinyl alcohol. |

| 5,404.19 | Others. |

| 5,404.90 | Others. |

| 5,405.00 | Monofilaments. |

| 5,405.00 | Artificial straw. |

| 5,405.00 | Imitation catgut with a diameter equal to or greater than 0.05 mm, but not exceeding 0.70 mm. |

| 5,405.00 | Imitations of catgut, except as included in 5405.00.03. |

| 5,405.00 | Others. |

| 5,406.00 | Made of polyamides or superpolyamides. |

| 5,406.00 | Aramid, flame retardant. |

| 5,406.00 | Polyester. |

| 5,406.00 | Other synthetic filament yarn. |

| 5,406.00 | Artificial filament yarns. |

| 5,407.10 | Used in tire armor, nylon or polyester, with a maximum of six threads per inch in the weft. |

| 5,407.10 | Recognizable for aircrafts. |

| 5,407.10 | Others. |

| 5,407.20 | Made of polypropylene strips and yarns. |

| 5,407.20 | Others. |

| 5,407.30 | Of synthetic fibers, unbleached or bleached. |

| 5,407.30 | Recognizable for aircrafts. |

| 5,407.30 | Nets or meshes of plastic materials, with monofilaments of less than 1 mm in cross section, where the crossing point is thermowelded, in rolls of width less than 2.20 m . |

| 5,407.30 | Others. |

| 5,407.41 | Raw or bleached. |

| 5,407.42 | Dyed. |

| 5,407.43 | Embossing. |

| 5,407.43 | Recognizable for aircrafts. |

| 5,407.43 | With width from 64 to 72 cm, for the manufacture of neckties. |

| 5,407.43 | Others. |

| 5,407.44 | Prints. |

| 5,407.51 | Raw or bleached. |

| 5,407.52 | Dyed. |

| 5,407.53 | Embossed or subjected to any complementary operation on the dyeing, including double or bonded fabrics. |

| 5,407.53 | Recognizable for aircrafts. |

| 5,407.53 | With width from 64 to 72 cm, for the manufacture of neckties. |

| 5,407.53 | Others. |

| 5,407.54 | Prints. |

| 5,407.61 | Made entirely of polyester, of single yarns, of a count of 75 decitex or more but not exceeding 80 decitex, and 24 filaments per yarn, and a twist of 900 turns per meter or more. |

| 5,407.61 | Unbleached or bleached, except for those covered by 5407.61.01. |

| 5,407.61 | Others. |

| 5,407.69 | Recognizable for aircrafts. |

| 5,407.69 | Others. |

| 5,407.71 | Raw or bleached. |

| 5,407.72 | Dyed. |

| 5,407.73 | Embossing, including double or bonded fabrics. |

| 5,407.73 | Recognizable for aircrafts. |

| 5,407.73 | Made of polyurethane, “elastic”, both in the foot and in the weft, with an elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.73 | Others. |

| 5,407.74 | Prints. |

| 5,407.81 | Raw or bleached. |

| 5,407.82 | Embossed, or subjected to any complementary operation on the dyeing, including double or bonded fabrics. |

| 5,407.82 | Recognizable for aircrafts. |

| 5,407.82 | Made of polyurethane, “elastic”, with elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.82 | Others. |

| 5,407.83 | With yarns of different colors. |

| 5,407.84 | Prints. |

| 5,407.91 | Associated with rubber threads. |

| 5,407.91 | Embossing, including double or bonded fabrics. |

| 5,407.91 | Polyvinyl alcohol fabrics. |

| 5,407.91 | Recognizable for aircrafts. |

| 5,407.91 | Made of polyurethane, “elastic”, both in the foot and in the weft, with an elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.91 | Nylon, with a weft of 40 deniers with 34 filaments and a foot of 70 deniers with 34 filaments. |

| 5,407.91 | Containing 36% or more by weight of wool or fine hair. |

| 5,407.91 | Others. |

| 5,407.92 | Associated with rubber threads. |

| 5,407.92 | Embossed or subjected to any complementary operation on the dyeing, including double or bonded fabrics. |

| 5,407.92 | Polyvinyl alcohol. |

| 5,407.92 | Recognizable for aircrafts. |

| 5,407.92 | Made of polyurethane, “elastic”, both in the foot and in the weft with an elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.92 | Containing 36% or more by weight of wool or fine hair. |

| 5,407.92 | Others. |

| 5,407.93 | Associated with rubber threads. |

| 5,407.93 | Embossing, including double or bonded fabrics. |

| 5,407.93 | Polyvinyl alcohol. |

| 5,407.93 | Recognizable for aircrafts. |

| 5,407.93 | With a width of 64 to 72 cm for the manufacture of neckties. |

| 5,407.93 | Made of polyurethane, “elastic”, both in the foot and in the weft, with an elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.93 | Containing 36% or more by weight of wool or fine hair. |

| 5,407.93 | Others. |

| 5,407.94 | Associated with rubber threads. |

| 5,407.94 | Embossing, including double or bonded fabrics. |

| 5,407.94 | Polyvinyl alcohol. |

| 5,407.94 | Recognizable for aircrafts. |

| 5,407.94 | With a width of 64 to 72 cm for the manufacture of neckties. |

| 5,407.94 | Made of polyurethane, “elastic”, both in the foot and in the weft, with an elongation capacity of 68 to 88% in the longitudinal direction (foot) and 90 to 120% in the transverse direction (weft). |

| 5,407.94 | Containing 36% or more by weight of wool or fine hair. |

| 5,407.94 | Others. |

| 5,408.10 | Associated with rubber threads. |

| 5,408.10 | Raw or bleached. |

| 5,408.10 | Recognizable for aircrafts. |

| 5,408.10 | Used in tire armor, rayon, with a maximum of 6 threads per inch of weft. |

| 5,408.10 | Others. |

| 5,408.21 | Associated with rubber threads. |

| 5,408.21 | Embossing, including double or bonded fabrics. |

| 5,408.21 | Recognizable for aircrafts. |

| 5,408.21 | Others. |

| 5,408.22 | Associated with rubber threads. |

| 5,408.22 | Embossing, including double or bonded fabrics. |

| 5,408.22 | Recognizable for aircrafts. |

| 5,408.22 | Made of cupramonium rayon. |

| 5,408.22 | Others. |

| 5,408.23 | Associated with rubber threads. |

| 5,408.23 | Embossing, including double or bonded fabrics. |

| 5,408.23 | Recognizable for aircrafts. |

| 5,408.23 | With a width of 64 to 72 cm for the manufacture of neckties. |

| 5,408.23 | Made of cupramonium rayon. |

| 5,408.23 | Others. |

| 5,408.24 | Made of cupramonium rayon. |

| 5,408.24 | Others. |

| 5,408.31 | Associated with rubber threads. |

| 5,408.31 | Embossing, including double or bonded fabrics. |

| 5,408.31 | Recognizable for aircrafts. |

| 5,408.31 | Containing 36% or more by weight of wool or fine hair. |

| 5,408.31 | Others. |

| 5,408.32 | Associated with rubber threads. |

| 5,408.32 | Embossed or subjected to any complementary operation on the dyeing, including double or bonded fabrics. |

| 5,408.32 | Recognizable for aircrafts. |

| 5,408.32 | Nets or meshes, with monofilaments of less than 1 mm in cross section, where the crossing point is thermowelded, in rolls of width less than 2.20 m . |

| 5,408.32 | Containing 36% or more by weight of wool or fine hair. |

| 5,408.32 | Others. |

| 5,408.33 | Associated with rubber threads. |

| 5,408.33 | Embossing, including double or bonded fabrics. |

| 5,408.33 | Recognizable for aircrafts. |

| 5,408.33 | Containing 36% or more by weight of wool or fine hair. |

| 5,408.33 | Others. |

| 5,408.34 | Associated with rubber threads. |

| 5,408.34 | Embossing, including double or bonded fabrics. |

| 5,408.34 | Containing 36% or more by weight of wool or fine hair. |

| 5,408.34 | Others. |

| 5,501.10 | Nylon or other polyamides. |

| 5,501.20 | Of polyethylene terephthalate, except 5501.20.02 and 5501.20.03. |

| 5,501.20 | Made of black polyethylene terephthalate, dyed in the mass. |

| 5,501.20 | High tenacity equal to or greater than 7.77 g per decitex (7 g per denier) consisting of a filament of 1.33 decitex and with a total decitex of 133,333 (120,000 deniers). |

| 5,501.20 | Others. |

| 5,501.30 | Acrylics or modacrylics. |

| 5,501.40 | Made of polypropylene. |

| 5,501.90 | Others. |

| 5,502.00 | Rayon cables. |

| 5,502.00 | Others. |

| 5,503.11 | Aramid. |

| 5,503.19 | Others. |

| 5,503.20 | Of polyethylene terephthalate, except those of 5503.20.02 and 5503.20.03. |

| 5,503.20 | Of high tenacity polyethylene terephthalate equal to or greater than 7.67 g per decitex (6.9 g per denier). |

| 5,503.20 | Made of black polyethylene terephthalate, dyed in the mass. |

| 5,503.20 | Others. |

| 5,503.30 | Acrylic or modacrylic. |

| 5,503.40 | Made of polypropylene from 3 to 25 deniers. |

| 5,503.40 | Others. |

| 5,503.90 | Of polyvinyl alcohol, of a length not exceeding 12 mm . |

| 5,503.90 | Others. |

| 5,504.10 | Short fiber rayon. |

| 5,504.10 | Others. |

| 5,504.90 | Others. |

| 5,505.10 | Made of synthetic fibers. |

| 5,505.20 | Made of man-made fibers. |

| 5,506.10 | Nylon or other polyamides. |

| 5,506.20 | Of polyesters. |

| 5,506.30 | Acrylic or modacrylic. |

| 5,506.90 | Others. |

| 5,507.00 | Artificial staple fibers, carded, combed or otherwise processed for spinning. |

| 5,508.10 | Made of synthetic staple fibers. |

| 5,508.20 | Made of man-made staple fibers. |

| 5,509.11 | Simple. |

| 5,509.12 | Twisted or wired. |

| 5,509.21 | Simple. |

| 5,509.22 | Twisted or wired. |

| 5,509.31 | Simple. |

| 5,509.32 | Twisted or wired. |

| 5,509.41 | Simple. |

| 5,509.42 | Twisted or wired. |

| 5,509.51 | Blended exclusively or mainly with man-made staple fibers. |

| 5,509.52 | Mixed exclusively or mainly with wool or fine hair. |

| 5,509.53 | Blended exclusively or mainly with cotton. |

| 5,509.59 | Others. |

| 5,509.61 | Mixed exclusively or mainly with wool or fine hair. |

| 5,509.62 | Blended exclusively or mainly with cotton. |

| 5,509.69 | Others. |

| 5,509.91 | Mixed exclusively or mainly with wool or fine hair. |

| 5,509.92 | Blended exclusively or mainly with cotton. |

| 5,509.99 | Others. |

| 5,510.11 | Simple. |

| 5,510.12 | Twisted or wired. |

| 5,510.20 | Other yarn, mixed mainly or solely with wool or fine animal hair. |

| 5,510.30 | Other yarns, mixed mainly or solely with cotton. |

| 5,510.90 | Other yarns. |

| 5,511.10 | Of synthetic staple fibers containing 85% or more by weight of these fibers. |

| 5,511.20 | Of synthetic staple fibers containing less than 85% by weight of these fibers. |

| 5,511.30 | Made of man-made staple fibers. |

| 5,512.11 | Raw or bleached. |

| 5,512.19 | Denim type. |

| 5,512.19 | Others. |

| 5,512.21 | Raw or bleached. |

| 5,512.29 | Others. |

| 5,512.91 | Raw or bleached. |

| 5,512.99 | Others. |

| 5,513.11 | Made of polyester staple fibers, taffeta weave. |

| 5,513.12 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less. |

| 5,513.13 | Other woven fabrics of polyester staple fibers. |

| 5,513.19 | Other fabrics. |

| 5,513.21 | Made of polyester staple fibers, taffeta weave. |

| 5,513.23 | Of twill weave including the cross weave, of course less than or equal to 4. |

| 5,513.23 | Others. |

| 5,513.29 | Other fabrics. |

| 5,513.31 | Made of polyester staple fibers, taffeta weave. |

| 5,513.39 | Of polyester staple fibers, twill weave (including cross weave), of a course of 4 or less. |

| 5,513.39 | Other woven fabrics of polyester staple fibers. |

| 5,513.39 | Others. |

| 5,513.41 | Made of polyester staple fibers, taffeta weave. |

| 5,513.49 | Of polyester staple fibers, twill weave (including cross weave), of a course of 4 or less. |

| 5,513.49 | Other woven fabrics of polyester staple fibers. |

| 5,513.49 | Others. |

| 5,514.11 | Made of polyester staple fibers, taffeta weave. |

| 5,514.12 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less. |

| 5,514.19 | Made of polyester staple fibers. |

| 5,514.19 | Others. |

| 5,514.21 | Made of polyester staple fibers, taffeta weave. |

| 5,514.22 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less. |

| 5,514.23 | Other woven fabrics of polyester staple fibers. |

| 5,514.29 | Other fabrics. |

| 5,514.30 | Made of polyester staple fibers, taffeta weave. |

| 5,514.30 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less, denim type. |

| 5,514.30 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less, except that of 5414.30.02. |

| 5,514.30 | Other woven fabrics of polyester staple fibers. |

| 5,514.30 | Others. |

| 5,514.41 | Made of polyester staple fibers, taffeta weave. |

| 5,514.42 | Of polyester staple fibers, twill weave, including cross weave, of a course of 4 or less. |

| 5,514.43 | Other woven fabrics of polyester staple fibers. |

| 5,514.49 | Other fabrics. |

| 5,515.11 | Blended exclusively or mainly with viscose rayon staple fibers. |

| 5,515.12 | Mixed exclusively or mainly with synthetic or artificial filaments. |

| 5,515.13 | Containing less than 36% by weight of wool or fine hair. |

| 5,515.13 | Others. |

| 5,515.19 | Others. |

| 5,515.21 | Mixed exclusively or mainly with synthetic or artificial filaments. |

| 5,515.22 | Containing less than 36% by weight of wool or fine hair. |

| 5,515.22 | Others. |

| 5,515.29 | Others. |

| 5,515.91 | Mixed exclusively or mainly with synthetic or artificial filaments. |

| 5,515.99 | Blended exclusively or mainly with wool or fine animal hair, containing less than 36% by weight of wool or fine animal hair. |

| 5,515.99 | Mixed mainly or solely with wool or fine animal hair, except 5515.99.01. |

| 5,515.99 | Others. |

| 5,516.11 | Raw or bleached. |

| 5,516.12 | Dyed. |

| 5,516.13 | With yarns of different colors. |

| 5,516.14 | Prints. |

| 5,516.21 | Raw or bleached. |

| 5,516.22 | Dyed. |

| 5,516.23 | With yarns of different colors. |

| 5,516.24 | Prints. |

| 5,516.31 | Containing less than 36% by weight of wool or fine hair. |

| 5,516.31 | Others. |

| 5,516.32 | Containing less than 36% by weight of wool or fine hair. |

| 5,516.32 | Others. |

| 5,516.33 | Containing less than 36% by weight of wool or fine hair. |

| 5,516.33 | Others. |

| 5,516.34 | Containing less than 36% by weight of wool or fine hair. |

| 5,516.34 | Others. |

| 5,516.41 | Raw or bleached. |

| 5,516.42 | Dyed. |

| 5,516.43 | With yarns of different colors. |

| 5,516.44 | Prints. |

| 5,516.91 | Raw or bleached. |

| 5,516.92 | Dyed. |

| 5,516.93 | With yarns of different colors. |

| 5,516.94 | Prints. |

| 5,601.21 | Wadding. |

| 5,601.21 | Others. |

| 5,601.22 | Wadding. |

| 5,601.22 | Others. |

| 5,601.29 | Others. |

| 5,601.30 | Acetate, rayon-viscose or linen “silk” specks. |

| 5,601.30 | Others. |

| 5,602.10 | Asphalted, tarred, tarred and/or with synthetic rubber additives. |

| 5,602.10 | Others. |

| 5,602.21 | Wool. |

| 5,602.21 | Cylindrical or rectangular in shape. |

| 5,602.21 | Others. |

| 5,602.29 | Of other textile materials. |

| 5,602.90 | Others. |

| 5,603.11 | Weighing 25 g/m² or less. |

| 5,603.12 | Of a width of 45 mm or less, for exclusive use in the manufacture of electric batteries. |

| 5,603.12 | Others. |

| 5,603.13 | Of aramid fibers, or fibers with dielectric properties based on rayon and polyvinyl alcohol, weighing more than 70 g/m² but less than 85 g/m². |

| 5,603.13 | Others. |

| 5,603.14 | Weighing more than 150 g/m². |

| 5,603.91 | Weighing 25 g/m² or less. |

| 5,603.92 | Weighing more than 25 g/m² but not more than 70 g/m². |

| 5,603.93 | Weighing more than 70 g/m² but not more than 150 g/m². |

| 5,603.94 | Weighing more than 150 g/m². |

| 5,604.10 | Textile coated rubber yarns and ropes. |

| 5,604.90 | Impregnated or coated with vulcanized rubber. |

| 5,604.90 | Of silk or silk waste, put up for retail sale; silk-worm gut; imitation catgut prepared from silk yarn. |

| 5,604.90 | Imitation catgut, of synthetic and artificial textile materials, continuous, except for fraction 5604.90.04. |

| 5,604.90 | Imitation catgut, of synthetic and artificial textile material, continuous, with a diameter equal to or greater than 0.05 mm, but not exceeding 0.70 mm. |

| 5,604.90 | Of man-made textile materials, except those of 5604.90.01. |

| 5,604.90 | Of wool, of hair (fine or coarse) or of horsehair, whether or not put up for retail sale. |

| 5,604.90 | Linen or ramie. |

| 5,604.90 | Of cotton, not put up for retail sale. |

| 5,604.90 | Made of cotton, put up for retail sale. |

| 5,604.90 | High tenacity yarn of polyesters, nylon or other polyamides or viscose rayon, impregnated or coated, recognizable for aircraft. |

| 5,604.90 | High tenacity yarns impregnated or coated with aramid fibers. |

| 5,604.90 | Impregnated or coated high tenacity yarns of polyamides or superpolyamides of 44.44 decitex (40 deniers) and 34 filaments. |

| 5,604.90 | High tenacity impregnated or coated rayon yarns of 1,333.33 decitex (1,200 deniers). |

| 5,604.90 | High tenacity yarn of polyesters, of nylon or other polyamides or of viscose rayon, impregnated or coated, other than those of 5604.90.10, 5604.90.11, 5604.90.12 and 5604.90.13. |

| 5,604.90 | Others. |

| 5,605.00 | Metallized yarn, whether or not gimped, being textile yarn, or strip or the like of heading 54.04 or 54.05, combined with metal in the form of thread, strip or powder or covered with metal. |

| 5,606.00 | Polyurethane yarns twisted or wound with yarns of polyamide or polyether textile fibers, with total decitex greater than 99.9 (90 deniers). |

| 5,606.00 | Yarn of polyurethane gimped or gimped with yarn of polyamide or polyether textile fibers, other than those of 5606.00.01. |

| 5,606.00 | Others. |

| 5,607.21 | Tying or baling twine. |

| 5,607.29 | Others. |

| 5,607.41 | Tying or baling twine. |

| 5,607.49 | Others. |

| 5,607.50 | Of other synthetic fibers. |

| 5,607.90 | Of abaca (Manila hemp (Musa textilis Nee)) or other hard fibers of leaves. |

| 5,607.90 | Of jute or of other textile bast fibres of heading 53.03. |

| 5,607.90 | Others. |

| 5,608.11 | With mesh size less than 3.81 cm . |

| 5,608.11 | Others. |

| 5,608.19 | Others. |

| 5,608.90 | Others. |

| 5,609.00 | Slings. |

| 5,609.00 | Others. |

| 5,701.10 | Wool or fine hair. |

| 5,701.90 | Of other textile materials. |

| 5,702.10 | Carpets called “Kelim” or “Kilim”, “Schumacks” or “Soumak”, “Karamanie” and similar hand-woven carpets. |

| 5,702.20 | Coir fiber floor coverings. |

| 5,702.31 | Wool or fine hair. |

| 5,702.32 | Made of synthetic or artificial textile material. |

| 5,702.39 | Of other textile materials. |

| 5,702.41 | Wool or fine hair. |