Last updated on November 7th, 2024 at 10:03 am

REPSE is a special registry for Mexican companies that outsource personnel. Outsourcing law in Mexico changed radically in 2021, implying a profound change in many of Mexico’s employment laws.

It is essential to distinguish what outsourcing means in this context. Our law perfectly allows companies to utilize outsourcing, a business practice where they hire services from a third party. We are discussing personnel outsourcing, a practice where one company employs individuals who physically work and perform their services at a different company’s location. Cleaning services and security are good examples of the types of specialized services that REPSE means.

To start, let me give you a little background. Firstly, lawmakers created the Mexican labor law under one fundamental principle of work stability. This principle aims to guarantee Mexican citizens the right to have a job and the certainty that they will be able to keep it. This fundamental principle is one of the reasons why severance pay in Mexico can get hefty if an employee has been working for the company for many years.

Secondly, profit-sharing is one of the workers’ constitutional rights in Mexico. Thirdly, social security in Mexico can increase employers’ payroll costs by about 30%.

Because of these regulations, it became the company’s national sport not to have employees. Here are some astonishing figures previous to Mexico’s outsourcing laws reform.

- 83% of Mexican companies outsourced their entire payroll.

- The other 17% outsourced 95.5% of their payroll

- Companies registered 75% of workers at IMSS with a (fake) lower salary

This is just the tip of the iceberg. The truth is that Mexican companies used to abuse payroll outsourcing. Therefore, lawmakers decided to reform the outsourcing law in Mexico. Thus, they created REPSE, the Specialized Work & Services Suppliers Registry.

Mexico’s Outsourcing Law Reform

When finding out about the previously mentioned figures, lawmakers decided to reform the outsourcing laws in Mexico to stop these bad practices. This was done in 2021. But it was no easy task. Several Mexican laws had to be changed for this to work.

Here’s a list of the reformed laws.

- The Federal Labor Law

- The Social Security Law

- Mexico’s Federal Tax Code

- The INFONAVIT Law (on Social Housing)

- The VAT Law

- The Income Tax Law

One of the most significant motivations for this reform was profit-sharing. Mexican companies must share 10% of their profits with their employees. However, companies used to outsource their entire payroll to other companies. These other companies manipulated their profits so they wouldn’t have to share them with the employees.

Mexico’s outsourcing law reform now prohibits personnel outsourcing. Article 12 of the LFT clearly states this. Let’s look at what it says.

Article 12 of the LFT.- The subcontracting of personnel is prohibited, understood as when an individual or legal entity provides or makes available its own workers for the benefit of another.

Employment agencies or intermediaries that intervene in the personnel hiring process may participate in the recruitment, selection, training and education, among others. They will not be considered employers, since this character is held by the person who benefits from the services.

Let’s analyze what this is saying. It is prohibiting the subcontracting of personnel; that part is clear. It also explains what this means, an individual or company providing its own workers for the benefit of another. This concerns the subordination that gives birth to an employment relationship in Mexico. Article 12 refers to the employees of one company go to work to another company. Those annoying legal nuances can get you in trouble if you don’t pay attention.

REPSE In Mexico

As we just saw, lawmakers prohibited outsourcing personnel as a general rule. However, there are some exceptions where the employees of one company can perform services at another company. Article 13 of the LFT states that a company can hire certain specialized services as long as they aren’t a part of the hiring company’s purpose. When starting a business in Mexico, you must choose your company’s purpose. It is a part of your incorporation deed. You can make it as broad as you want, but you must consider Mexico’s outsourcing laws. If, for example, you include cleaning services in the company’s purpose, you won’t be able to outsource that service.

Article 14 of the LFT states that the relationship between the supplier of the personnel and the client must be clearly stated in a written contract, including the following.

- The object of the services to be provided or work to be done.

- The approximate number of workers will be at the client’s disposal.

Specialized Services Allowed By REPSE In Mexico

REPSE in Mexico allows for certain specialized works to be outsourced.

- Brokerage services for selection, recruiting, and employee training. The third party cannot be the employer of these employees but can help in the hiring process.

- Specialized services that are not a part of the hiring company’s purpose. Security and cleaning services are good examples of this.

Since the outsourcing law in Mexico was reformed, companies got scared and started requesting that all their suppliers register at REPSE. However, it is important to understand that this also implies a big risk for the hiring company since it becomes jointly obligated to pay the employees’ Social Security.

REPSE Website

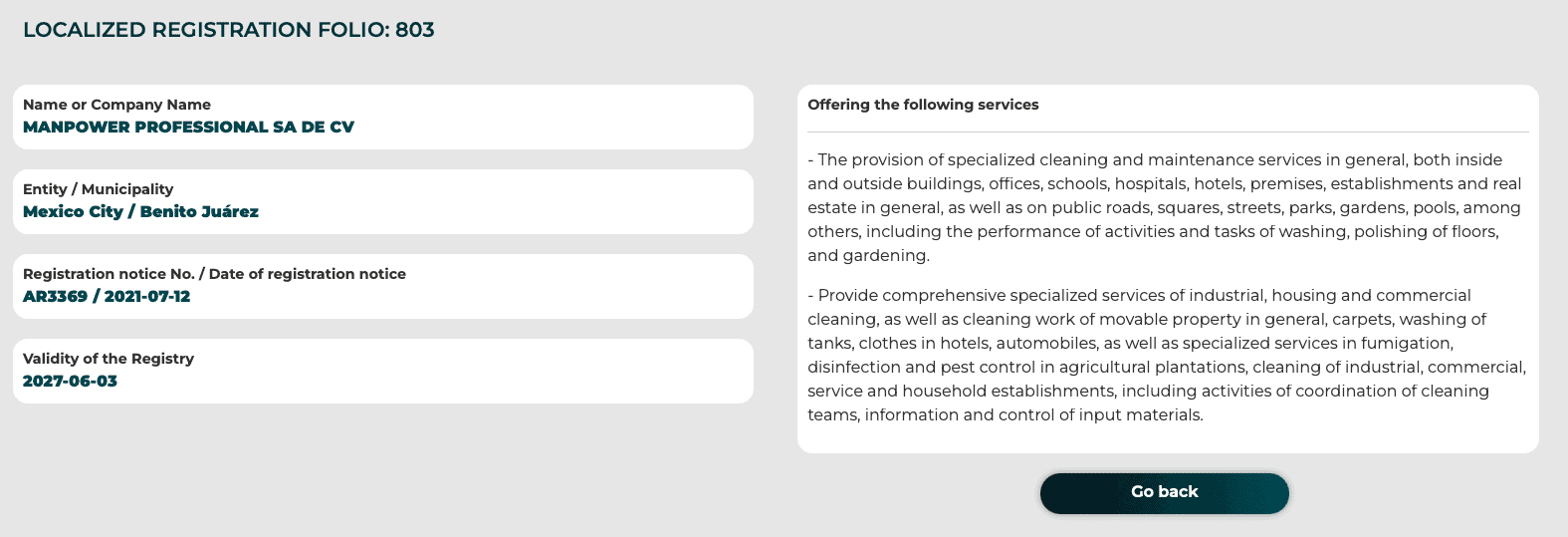

RESPSE has a website where companies can do two things. First, we can search to see if a supplier of specialized services is registered at REPSE. This is very important, since sanctions are involved, which we will see in a moment.

Basically, you can look for a supplier by entering the name of their company, and if the supplier is registered in REPSE, you will get all of the related information, like its registry number and the type of specialized services he is permitted to offer. Certainly, this is public information.

Secondly, REPSE’s website is where you apply for your company’s registry if you supply specialized services. Let’s see how that’s done.

How To Register In REPSE In Mexico

In the begining there was a generalized misundertanding of how to register. Therefore, REPSE issued two documents with guidelines on registering and specifying who should register. The first is the General Rules and provisions for the registry at REPSE, and the second is an official guide for REPSE. Let’s look at the registration requirements.

- A valid corporate E-Signature.

- Being current in payments to SAT, IMSS, and INFONAVIT.

- A tax status sheet (Constancia de Situación Fiscal).

- The latest bimonthly proposal of the IMSS quota determination form.

- A scanned copy of the incorporation deed.

- ID of the legal representative.

- Employer ID card (issued by IMSS)

- A payslip of one of your workers.

Who Must Register In REPSE?

The government has created a system where clients request their suppliers to register. They managed to do this by penalizing the companies that hire outsourcing personnel from unregistered companies. However, it is important to understand that not all companies must be registered at REPSE.

I can think of hundreds of examples where the nature of the service does not require it. For example, you may buy an air conditioner and have someone install it at your office. In this case, the air conditioning company does not need to be in REPSE, and there’s no need for an agreement between the two companies.

At first, when the outsourcing law reform was just passed, many companies panicked and requested all suppliers register. But this is a double-edged sword; if you enter into an agreement with a company where they will outsource personnel to you, you become jointly liable for the payments of employee benefits like Social Security, vacations, withholding taxes, etc.

So, getting into this type of contract is important only if the relationship requires it.

Here are some services that do not need to be registered:

- Remote cloud services

- Remote network services

- IT services

If a company renders the services physically and gets its employees to the client’s facilities, outsourcing laws considers these specialized. Some examples are:

- Gardening

- Corporate cafeteria services

- Security

- Cleaning

- On-site recruiting & training

Penalties For Non-Compliance

As stated before, the government created the system so that the companies that hire the services enforce the registration of their suppliers. Let’s take a look at how it works.

If a company were to hire specialized services from another company not registered at REPSE, the following would happen:

- The hiring company cannot deduct the payments for the specialized services, meaning its taxable base becomes larger.

- It cannot credit the VAT paid to the specialized services company. This means the 16% VAT would become an expense since it cannot be credited.

Besides these consequences, there are fines and penalties for failing to cooperate with the Ministry of Work and Social Welfare inspections. These fines can get hefty, up to 50,000 UMAs (an economic measurement unit). In 2024, this is around USD 290,000.

Conclusion

The abuse in the figure of outsourcing of personnel led Mexican lawmakers to take extreme measures and have an outsourcing law reform. As a result, REPSE in Mexico was born. REPSE is a registry for suppliers of certain specialized services that outsource their personnel.

REPSE has a website. In this website, you can ensure a supplier is duly registered as provider of specialized services. Suppliers can also register their companies as providers of specialized services on that same website.

Hiring a specialized service provider carries a risk; the hiring company becomes jointly liable for the employee benefits of its supplier. Conversely, if your supplier is not duly registered, your company will be unable to deduct those payments as expenses or credit the VAT.

Add your first comment to this post