Last updated on November 26th, 2024 at 12:36 pm

Severance pay in Mexico may seem complicated, but it boils down to two things: paying the accrued benefits up to that moment, known as finiquito, and paying the severance. This is important to know if you want to start a business in Mexico. But let us start from the beginning.

If you have been reading our blog, you may know that, according to Article 46 of the Mexican Federal Labor Law, severance pay is among the mandatory employee benefits in Mexico. So, unlike in the United States, at-will employment is not allowed. At-will employment means the employer can terminate a labor relationship for any reason.

Employment laws in Mexico seek to create indefinite labor relations between employers and employees, meaning they do not end at a specific time. Our constitution has a “work stability” principle, so labor laws are created around it. Therefore, if a company wishes to terminate a labor relation, it usually must pay severance to the employee.

Of course, there are some scenarios where a “justified termination” may happen. Employees must not pay severance in these cases. But, the reality is that labor laws protect employees, giving the employer the burden of proof. Therefore, it is usually better to negotiate a deal with the employee, even if the cause is justifiable. So, even if this hurts your ego, you must negotiate the severance pay in Mexico.

This article aims to give you all the tools you need for a successful negotiation. So, let us begin with the three scenarios in which a labor relationship may end.

When Is Severance Pay In Mexico Necessary?

Scenarios For The Termination Of A Working Relationship In Mexico

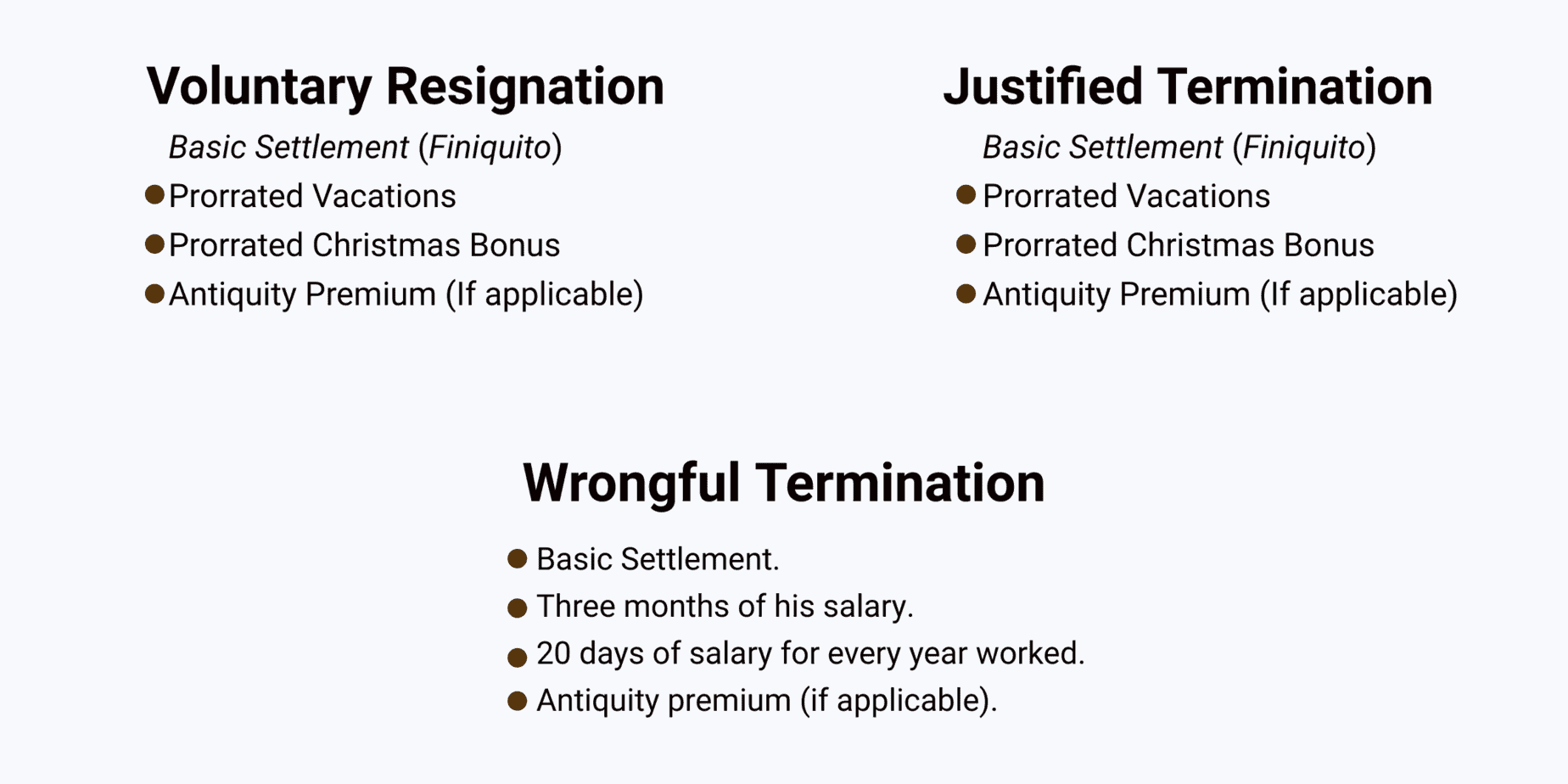

- Voluntary Resignation. If an employee quits his job, he is entitled to the payment of his prorated vacations, vacation premium, and Christmas bonus. Prorated means the amount accumulated that year up until the moment he resigned. We call this the “basic settlement” or “finiquito,” in case you want to learn Mexican labor slang. If the employee worked for over 15 years in the company, he is entitled to an “antiquity premium.” Antiquity premium is 12 days of salary for every year worked, capped at two Mexican minimum wages.

- Justified Termination. If there is a valid reason for the termination, the severance package is the same as a voluntary resignation. It is composed of the essential settlement and antiquity premium, if applicable.

- Wrongful Termination. If an employee’s termination is unjustified, the employee is entitled to the following severance pay in Mexico.

- (1) Three months of his salary.

- (2) 20 days of salary for every year worked.

- (3) The essential settlement and antiquity premium, if applicable.

Voluntary Resignation: No Severance Pay In Mexico

Voluntary resignation is a unilateral act by which an employee decides to terminate the labor relationship. In Mexico, the severance payment for a voluntary resignation is called finiquito (settlement). The basic settlement is the accrued benefits the employee had until the moment of resignation. We will see how to calculate that in a moment.

Article 5 of the Mexican Constitution establishes the principle of freedom of work from the chapter on human rights. Let us examine the most essential part of it.

Article 5 of the Mexican Political Constitution. No person may be prevented from engaging in the profession, industry, trade or work that suits him, being lawful…

The Mexican Federal Labor Law does not prohibit an employee from quitting his job or specify how he must resign. Therefore, there are no specified legal formalities. However, it is always best to have documentation in case of a legal conflict, so both the employee and the company should strive to get it in writing.

Notice Period

The fact that employees do not need to give companies a notice period before quitting under Mexican labor law baffles some of our clients. But, for the same reason, an employee can resign whenever he seems best; you can not force them to give a notice period. A notice period would go against Article 5 of the Constitution and the freedom of work principle.

Therefore, forcing someone to remain working for your company while this person wants to work somewhere else is against the law. However, the fact that the law does not explicitly state it does not mean you cannot request it from your employees. You may not be able to take legal action against an employee if he does not notify you in time, but if you ask them to, there is a good chance that you will get a positive response.

Documentation Of Resignation

The laws do not stipulate that a worker’s resignation must be formal, meaning it can be oral or written. However, the employer must prove that the worker terminated the employment relationship.

In this regard, we recommend requesting a written resignation from the worker where at least the following is stated:

- Full name of the worker.

- Full name of the employer.

- Place and date of drafting the document.

- Position the worker held.

- Reasons for the resignation.

- Signature and fingerprints of the worker.

- Signature of 2 witnesses.

If you want to make it more legally binding, you can get a certified copy from a Mexican Notary Public as soon as this is signed. This gives it date certainty, which means the document is recognized to have been signed at a specific date. This is very helpful in case of a lawsuit.

Justified Termination: No Severance Pay In Mexico

One of our clients’ most recurrent questions is how to terminate an employment relationship if the employee is problematic or does not meet our standards. The answer is that it is technically possible but hard to achieve. Let’s get legal. In this case, you are not terminating the contractual relationship but nullifying it. The legal term for it is “rescission.”

Rescission: the revocation, cancellation, or repeal of a law, order, or agreement.

Article 47 of the LFT states the causes for the rescission of the employment relationship without liability for the employer. Let us take a look at the most important ones.

Article 47 of the LFT, Fraction I . Misleading the employee or, as the case may be, the union that proposed or recommended him/her with false certificates or references in which the employee’s capacity, aptitudes or faculties are attributed to him/her that he/she lacks. This cause for termination shall cease to have effect after thirty days of rendering services to the employee;

So, as the fraction states, if the employee falsifies his title or references or lies about his capabilities, the company has 30 days to fire him without paying severance. This sounds nice, but you also have to consider that there is a trial period of 30 days for regular workers and up to 180 for directors. So, this does not help too much. However, if you want to use this article’s fractions, you, the employer, must prove it. How? That should be fairly easy if you find out the employee falsified a document. But how do you prove he does not have the capabilities he said he has?

The answer: Job Applications and questionnaires. Suppose you require potential employees to fill out these documents about their skills and knowledge. In that case, you will save your company a lot of money in Mexican severance pay. Let us take a look at the second fraction.

Article 47 of the LFT, Fraction II. The employee, during his work, incurs in breaches of probity or honesty, in acts of violence, threats, insults, or bad treatment against the employer, his family members or the management or administrative personnel of the company or establishment, or against clients and suppliers of the employer, except when provoked or when acting in self-defense;

This is a hard one. Who decides what constitutes probity and honesty? These two words mean essentially the same. However, many lawsuits have been filed throughout history, and Mexican judges have further defined this. It has become a case law in some cases, meaning if five similar cases have the same resolution, it becomes mandatory. So, let us look at some things that would fall under the umbrella of breaches in probity and honesty.

- Sleeping on the job.

- Using the company’s vehicle for personal purposes.

- If, during a sick leave, he works for another company.

- If the employee competes unfairly with the employer offering similar services using its know-how.

Many more cases exist where it would be considered a lack of honesty. These are only a few. Let us take a look at fraction three, which further details this.

Article 47 of the LFT, Fraction III. The employee commits any of the acts listed in the preceding section [Fraction II] against any of his co-workers, if as a consequence of such acts the discipline of the place where the work is performed is disturbed;

Ok, this one is more straightforward. A common example would be two coworkers getting aggressive toward each other and starting a fistfight. The employer must prove that the aggression not only happened but also disturbed the workplace if he wants to avoid severance pay in Mexico.

Article 47 of the LFT, Fraction IV. The employee commits, outside the service, against the employer, his family members or administrative management personnel, any of the acts referred to in section II, if they are so serious that they make it impossible to comply with the employment relationship;

The important part about this fraction is that it does not confine the conduct to the office or workplace. If any probity breaches happen outside the office, he can be accountable, too. The tricky part is that these actions must be so severe that complying with the labor relationship becomes impossible. I wish I could give you a concrete example here. Unfortunately, I have not seen such a case.

Article 47 of the LFT, Fraction V. Intentionally causing material damages to buildings, works, machinery, instruments, raw materials and other objects related to the work during the performance of the work or in connection therewith;

This is straightforward, but keep in mind you have to prove it. Here are some recommendations.

- Have video recording in the workplace. If you record someone causing damage to the equipment, you can use the video as proof.

- Witnesses. Getting employees to turn on each other can get tricky, but if you find out someone witnessed this, he can testify against the employee.

The material damages referred to in this fraction can be of all sorts, e.g., drawing bathrooms, damaging the tables or chairs, machines, etc.

Article 47 of the LFT, Fraction VI. Causing the employee the damages referred to in the preceding section, provided that they are serious, without malice, but with such negligence that it is the sole cause of the damage;

The key distinction between this fraction and the last one is intent. In this one, you can end the relationship without severance pay even if the employee had no intention of damaging the assets. However, the employee must act with serious negligence. There are a lot of YouTube videos of forklift drivers causing big damage to the inventory or even the building. If you can, for example, prove that the driver was texting while doing it, you would have a justified cause for recession.

There can be countless examples of this. If an employee used the wrong chemical and ruined machinery. Putting the wrong type of gas into a vehicle. You name it.

In this cases it is important to act fast. The first thing your HR department should do is draw up an administrative report and have the employee sign it.

Article 47 of the LFT, Fraction VII. Compromising the worker, by his imprudence or inexcusable carelessness, the safety of the establishment or of the persons who are in it;

We continue with negligence. If an employee puts the safety of the workplace and his colleagues at risk, it may be a cause of rescission without paying Mexican severance. I see it hard that this happen in a software developers office, but you never know how far can someones imprudence get. A good example for this would be an employee smoking near gas or oxygen taks.

Article 47 of the LFT, Fraction VIII. Committing immoral acts or acts of harassment and/or sexual harassment against any person in the establishment or workplace;

This one is simple. It is important that your employees file an internal complain if this were to happen. Also, there is the possibility of the victim taking legal action against the ofender.

Article 47 of the LFT, Fraction IX. Revealing trade secrets or disclosing matters of a reserved nature, to the detriment of the company;

There are a couple of important things to note here. The good news is you can fire an employee without paying severance in Mexico if they reveal your company’s trade secrets. But that is probably not enough, right? Unfortunately, our Constitution does not allow fines for workers higher than one day of salary. Therefore, if you want to protect your company’s trade secrets, you must sign a confidentiality agreement. If you do that, the industrial property laws will protect your trade secrets. This way, you could demand additional sanctions for your employee if he discloses them.

Article 47 of the LFT, Fraction X. The employee has more than three absences in a period of thirty days, without permission from the employer or without a justified cause;

This one is one of the favorites because it reflects the employees’ lack of enthusiasm and commitment. As simple as it sounds, more than three absences in 30 days and you can fire him without paying severance in Mexico. You may think that this would be easy to prove, but in practice, it is a hassle. To prove this, you have to do the following.

- Prove that the employee was absent for at least four days in 30 days.

- Prove that he had no medical proof or doctor’s note to justify it.

If you wish to prove this, it is very important to have a system of assistance with biometrics or a check-in clock. This makes it a lot easier to prove. Also, you have to make sure to document all four absences. If you fire the employee on the fourth day of insistence instead of documenting it, he technically only was absent for three days.

Article 47 of the LFT, Fraction XI. Disobeying the employer or his representatives, without just cause, as long as the work is contracted;

This one is very tricky. If you tell an employee to do something and he does not, you would consider this a reason to fire him. But was the requested instruction among his contractual obligations? That is one thing to think about. Another question is whether the person who gave the order was his superior. Clearly state this in the contract or organizational documents if you wish to use this as a cause for rescission. However, if everything is in order and the employee disobeys, there’s a cause for termination without paying severance.

Article 47 of the LFT, Fraction XII. Refusal of the worker to adopt the preventive measures or to follow the procedures indicated to avoid accidents or illnesses;

Companies must take measures to avoid accidents through a special Mixed Safety and Hygiene Commission. Suppose one of your workers refuses to adopt these measures, for example, not wearing gloves when handling hazardous chemicals or wearing an industrial belt to carry heavy objects. In that case, this is the cause of rescission.

Article 47 of the LFT, Fraction XIII. Attending work in a state of drunkenness or under the influence of any narcotic or enervating drug, unless, in the latter case, there is a doctor’s prescription. Before starting work, the employee must inform the employer of the fact and present the prescription signed by the physician;

This is a good one. You would think that if the employee shows up drunk or under the influence of drugs, it would be as easy as firing him on the spot. Unfortunately, there is more to it. You have to understand that for this to hold in a court of law, you must be able to prove the employee was indeed under the influence. This would also be a breach of probity (Fraction II) and endanger his coworkers and the workplace.

Now, how drunk is being drunk? Some court resolutions deny the rescission because of this. Some court resolutions state that having alcoholic breath does not mean you are intoxicated. Think about it. If the employee shows up to work and smells like he has been drinking, and you leave it at that, you won’t have a case against him. If the company’s doctor makes a breathalyzer test and documents it, you stand a chance. Creating an administrative record and having the employee sign it, acknowledging their intoxication, is even better.

Also, you have to understand that this does not apply to office parties. If you allow alcohol in the workplace, you cannot complain about the employees getting drunk. That is only a natural consequence.

Article 47 of the LFT, Fraction XIV. The enforceable sentence that imposes a prison sentence on the employee, which prevents him/her from complying with the work relationship;

This one is pretty straightforward. You can terminate the relationship without paying severance if your employee goes to jail. However, it is really important not to assume this happens automatically. If the employer does not formalize the rescission of the contract, it would be considered a suspension. And, if the employee comes out of prison, he can retake his job. Believe me, as weird as it sounds, this has happened.

Article 47 of the LFT, Fraction XIV Bis. The lack of documents required by the laws and regulations, necessary for the rendering of the service when it is attributable to the employee and that exceeds the period referred to in section IV of Article 43;

The employees must have the required documents to perform their jobs, like a driver’s license for a driver. If he does not have them, the employment relationship will be suspended. If, after two months, the employee does not get the required documents, you can terminate the relationship without severance pay in Mexico.

Article 47 of the LFT, Fraction XV. Those analogous to those established in the previous fractions, equally serious and with similar consequences as far as work is concerned.

This last one is just a way to keep the article open to more similar breaches an employee could perform. For example, Articles 134 and 135 of the LFT, discuss employee’s obligations. If an employee were not to fulfill his obligations, there would be a reason for a rescission of the contract.

The consucts in article 47’s fractions may sound simple, however, you must be aware that, in practice, it is always hard to prove. Here are a few tips to help you.

- Have a well-documented Internal Work Regulation.

- If an employee breaches one of these fractions, make sure you issue a warning or administrative record signed by your company’s legal representative and the worker. It must include both parties’ names and addresses.

- Whenever possible, get a witness to sign in the administrative record as well.

Another important thing is that you must notify your worker. When you fire someone, you must deliver a notice to the employee in person. You must clearly and formally state the termination date and the conduct that justifies the termination according to the Federal Labor Law. The employee must sign this notice to acknowledge receipt and understand its contents. Ever since the 2019 reform, the court has automatically considered it an unjustified termination if you do not do this. This means you must pay Mexican severance.

Severance Pay In Mexico: How To Calculate It

Resignation & Justified Termination

Calculation and payment of the basic settlement (“finiquito”)

As mentioned earlier, the basic settlement consists of:

- Prorated vacations & vacation premiums,

- Accrued Christmas bonus

- Antiquity premiums, if applicable.

Let us look at an example: Mariana, our company’s secretary, started working in 2007 and resigned on March 30, 2024. Here is all the information we need.

- Mariana’s monthly salary is 12,000 Mexican pesos.

- This means she has a daily wage of $400 (12k / 30 days)

- Her Christmas bonus is 15 days, which is the minimum requirement.

- She worked in the company for 17 years, so she is entitled to:

- 22 days of vacation.

- Antiquity premium.

- She has not taken vacations in 2024.

Prorated Vacations

First, let us calculate her prorated vacations. There are many ways of mathematically doing this; this is just one of them. First, according to Article 80 of the Labor Law, companies must pay a 25% premium on vacation days. Therefore, for those days, Mariana must be paid her daily salary of $400 + 25% = $500.00.

Since she did not work for the year, how much is owed for the accrued vacations? To find out, we will convert her vacation to a daily amount and multiply it by the number of days she worked.

- $500 (salary + premium) * 22 vacation days per year = $11,000

- $11,000 / 365 years = $30.14 per day

Now, months may have different days, so using an Excel file to calculate the days would be a good idea. For practical purposes, Mariana worked 90 days in 2024, so she would be entitled to:

- 90 days * 30.14 vacations per day = $2,712.60

Prorated Christmas Bonus

Mariana is entitled to her yearly proportional Christmas bonus, which is 15 days of salary. Our Christmas Bonus: Aguinaldo’s Guide article explains that we must first get a factor.

- We divide the 15 Christmas bonus days by 365 (the total days in a year); this gives us a factor. 15 days / 365 days = 0.041

- We multiply 0.041 times 90 days, the days Mariana worked on her last year. 0.041 * 90 = 3.69 Accrued Days

- Finally, we multiply this by her daily salary, $400 * 3.69 = $1,476.00 Accrued Christmas Bonus.

Antiquity Premium

Finally, Mariana resigned after working for more than 15 years in the company and was not a trusted employee, so she is entitled to an antiquity premium. According to the law, this premium is calculated as 12 days of salary per year worked, capped at two Mexican minimum wages. We will use the daily salary since twice the current minimum wage is more than $400. Let us get to it.

- First, we multiply $400 by 12, resulting in $4,800, the amount we must pay per each year worked.

- Then, we multiply the annual amount by Mariana’s years in the company: $4,800 * 17 years = $81,600.

With all the above in mind, we can calculate Mariana’s basic settlement as follows:

- Prorated vacations = $2,712.60

- Prorated Christmas Bonus = $1,476.00

- Antiquity premium = $81,600.00

- Total = $85,788.00

Unjustified Or Wrongful Termination

Finally, we come to the main course: wrongful termination. Many of our clients mention how advantageous wrongful termination seems for the worker: Why should I reward them when dismissing them?

Wrongful termination can occur for various reasons: company closure, a complicated relationship with the worker, implementation of machinery that can easily replace the worker, or simply because a justified reason for dismissal was not properly communicated to the worker, as discussed in the previous section.

In essence, wrongful termination is a unilateral act in which the employer decides to terminate the employment relationship with the worker.

In this regard, when being unjustifiably dismissed, the worker will have the following options:

- Request severance payment.

- Request for the reinstatement of their job.

They usually want the former. So, let us see how to calculate severance payments in Mexico.

Severance Pay In Mexico

Let’s use Mariana as an example. Imagine she did not resign, but she was a very clumsy employee, and you decided to fire her.

As we stated earlier, here is what a severance payment in Mexico looks like for a wrongful termination.

- (1) Three months of her salary.

- (2) 20 days of salary for every year worked.

- (3) The essential settlement and antiquity premium, if applicable.

We already calculated Mariana’s basic settlement. So, let us get to the severance payment.

To calculate it, let us retake a look at Mariana’s information.

- Mariana’s monthly salary is 12,000 Mexican pesos.

- This means she has a daily wage of $400 (12k / 30 days)

- Her Christmas bonus is 15 days, which is the minimum requirement.

- She worked in the company for 17 years, so she is entitled to:

- 22 days of vacation.

- Antiquity premium.

- She has not taken vacations in 2024.

Three months of salary

This is not hard to calculate. If Mariana made 12,000 monthly, we must pay her three times that amount.

- $12,000 * 3 = $36,000

20 days of salary for every year worked.

We know Mariana made $400 daily and worked for 17 years for the company. So, let us calculate this part of the severance pay.

- 17 years * 20 days per year worked = 340 days.

- 340 days * $400 daily salary = $136,000

Basic Settlement

We have already calculated her basic settlement before. Here it is again.

- Prorated vacations = $2,712.60

- Prorated Christmas Bonus = $1,476.00

- Antiquity premium = $81,600.00

- Total = $85,788.00

Therefore, we know that her severance pay looks like this:

- Three months of salary = $36,000

- 20 days of salary per year worked = $136,000

- Basic Settlement = $85,788

Conclusion

Severance pay in Mexico is not complicated but heavily favors the employee. An employment relationship can end in three ways.

- If the employee resigns.

- If the employee is fired with a just cause.

- If the employee is fired without a cause.

Firing employees with a justifiable cause is hard. To the point where it is always best to negotiate a paid termination. Mexico’s legal system seeks employees and employers to conciliate their differences before engaging in a legal dispute. So, feel free to deal with your employees if you are about to terminate the relationship. Just make sure to document the termination formally.

6 Comments

If the employee’s job ceases due to the employer moving to another country and has worked 1 day per week for about 14 years as a cleaner with excellent references, do we use the justified termination formula? If so, what does the cap at 2 minimum wage mean?

Thanks for any help.

Hi Mary, thank you for your comment. This one is tricky. If the employer is moving to another country, the termination of the labor relationship is responsibility of the employer. This means it is an unjustified termination. Now, granted that the circumstances are extraordinary, I would talk to the employee, explain the situation and come up with a mutually beneficial solution.

I hope this helps!

Hi , what is the minimum amount of time an employee needs to have worked to get finiquito?

Hi Oliver, thanks for your comment. Finiquito is the accumulation of benefits so they start adding up from they one.

If the employee in Mexico is a Chinese person with Mexican residency and they work in Mexico do you go by Chinese or Mexico labor law regarding severance? Even in justified termination circumstances

Hi JJK! Thanks for your comment. If the person is employed in Mexico, the Mexican labor laws apply.

I hope this helps!