Article 168 of the Mexican Social Security Law

The quotas and contributions referred to in the preceding article will be:

- In the retirement branch, employers are responsible for covering the amount equivalent to two percent of the worker’s base contribution salary.

- In the branches of unemployment at advanced age and old age:

- Employers will cover the corresponding contribution on the base contribution salary, calculated in accordance with the following table:

*Minimum Wage

*Minimum Wage

** Measuring and Updating Unit - Workers will pay a fee of one point one hundred and twenty-five percent of the base contribution salary.

Section II amended by the Decree amending, adding and repealing several provisions of the Social Security Law and the Retirement Savings Systems Law, published in the Official Gazette of the Federation on December 16, 2020. - [Repealed.]

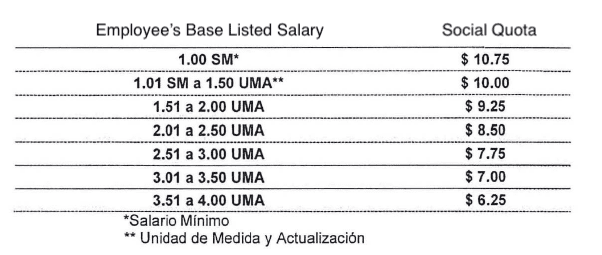

Section III added by the Decree amending, adding and repealing several provisions of the Social Security Law and the Retirement Savings Systems Law, published in the Official Gazette of the Federation on December 16, 2020. - The Federal Government, for each day of salary contributed, will contribute monthly an amount for the social contribution, for workers earning up to four times the unit of measurement and updating, which will be deposited in the individual account of each insured worker according to the following table:

Section IV amended by the Decree amending, adding and repealing several provisions of the Social Security Law and the Retirement Savings Systems Law, published in the Official Gazette of the Federation on December 16, 2020.

The aforementioned values of the amount of the social contribution will be updated quarterly in accordance with the National Consumer Price Index, in the months of March, June, September and December of each year.

These quotas and contributions, when destined to the granting of pensions and other benefits established in this Law, will be understood to be destined to the public expense in matters of social security.

- Employers will cover the corresponding contribution on the base contribution salary, calculated in accordance with the following table:

Paragraph amended by Sole Article of the Decree of 04/30/2009, published in DOF. Diario Oficial de la Federación, May 26, 2009.